Traders lost $200 million after trading Shiba Inu SHIB token and DOGE, especially after Ethereum’s Vitalik Buterin dumped a part of his stack as we reported recently in our altcoin news.

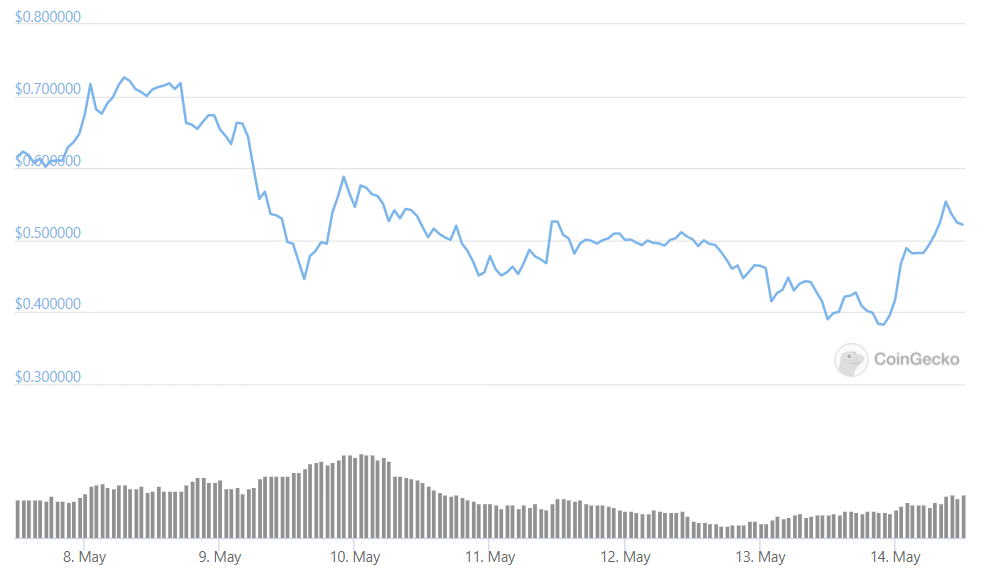

While Dogecoin was memed into legitimacy by the likes of Elon Musk, the Shiba Inu token went from near-obscurity to temporarily become the 12th biggest cryptocurrency earlier this week with a market cap of $12 billion. Some SHIB traders made millions with a few dollars of investment as the token increased 34,932,200% from its all-time low in November. The ByBt data shows traders that bet on Shiba’s upside were liquidated on Wednesday night. The Liquidations for those that don’t know, occur when leveraged positions are automatically closed out by brokerages as a safety mechanism.

Futures and margin traders borrow capital from exchanges to place bigger bets or to put up a smaller collateral amount before placing a trade so if the market moves against them, the collateral is fortified and the position is liquidated. SHIB dropped by 40% and the likely culprit was the market’s reaction to Buterin dumping a part of his stash and donated over $1 billion worth to India’s coronavirus relief fund. And the spot drop caused a near-cascading effect with over $148 million were liquidated while $83.15 million were liquidated.

Of the Shiba Liquidations, $44.59 million occurred on exchange Huobi, $38 million on OKEX, and $485,000 on FTX. The remaining $10 million was liquidated on the Binance 1000 SHIB product where each contract represents 1000 shib tokens. In the meantime, the memecoin traders lost $200 million after trading DOGE and SHIB. About 382,000 traders were liquidated overall with the biggest liquidation order taking place on Huobi.

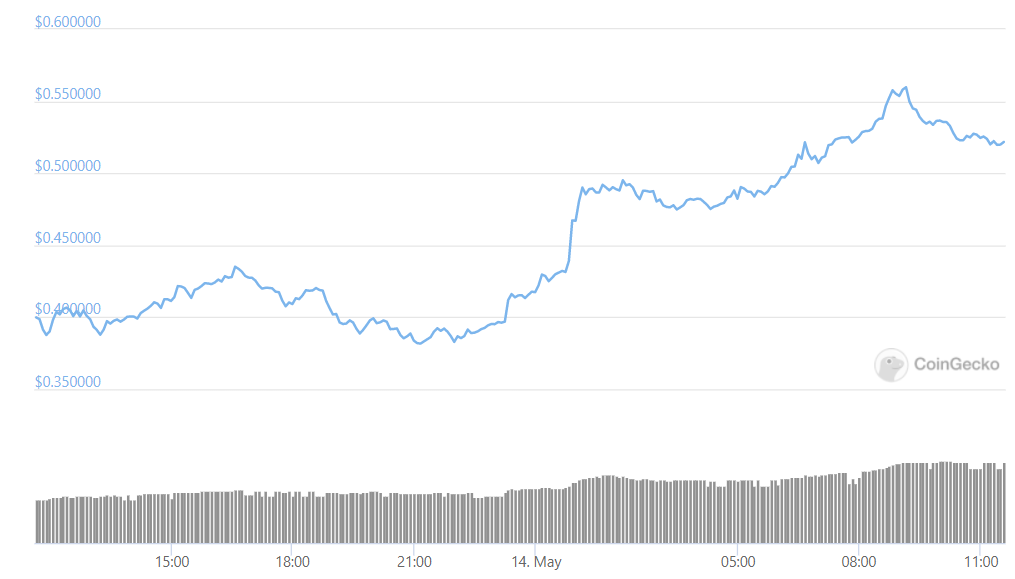

As recently reported, Cryptocurrency prices were down over the past few days especially for DOGE but the US crypto exchange Coinbase announced today that it will allow trading on the token soon. DOGE crashed for as low as $0.38 at one point and it is now going for $0.50 across exchanges where it listed including FTX, Kraken, and Binance. Coinbase could list it in the next 4 to 6 weeks according to CEO Brian Armstrong as he said during an earnings call, and said it could cut into mobile trading app Robinhood’s DOGE business. After chasing down Robinhood for a few weeks, Coinbase overtook it and became the fourth most popular app on the Apple store and the third-most-popular Android download.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post