Tesla stops BTC payments over the environmental concerns and sent the coin to a new session low as we can see in our latest Bitcoin news today.

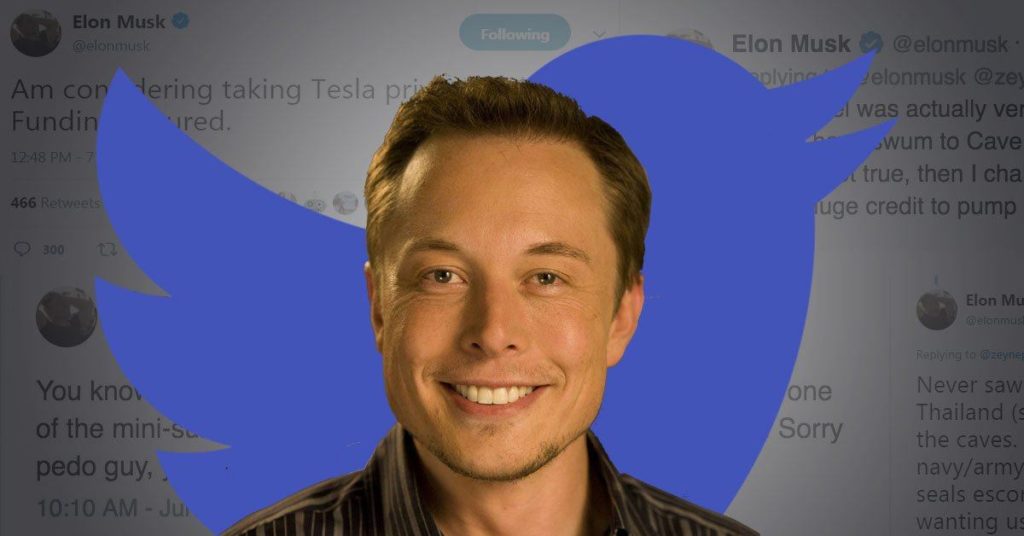

Earlier this year in what seemed to be a huge win for the crypto space, Tesla started accepting payments in bitcoin and this move was widely supported and celebrated for legitimizing Bitcoin’s transactional utility beyond a speculative asset class. Tesla’s CEO Elon Musk posted on Twitter to announce that Tesla stops BTC payments because of concerns over the rapidly increasing use of fossil fuels for BTC mining. The concerns are nothing new as many already criticized the digital asset and its proof of work system for the hefty electrical consumption.

Tesla & Bitcoin pic.twitter.com/YSswJmVZhP

— Elon Musk (@elonmusk) May 12, 2021

Bitcoin’s surge in price has incentivized miners to expand their operations which led to an annualized consumption levels that surpassed that of smaller nations. According to the University of Cambridge’s Bitcoin Electricity Consumption Index, the miners around the world account for 147 terawatts in electrical consumption which is about 0.5% of global power usage. After the announcement, bitcoin prices dropped 10% to $51,000. According to the options data from Deribit Metrics, the bearish sentiment seems to be setting in on the futures market as well with the volume of BTC skyrocketing to a daily notional value of $225 million which is more than double the trading volume at the end of May. At press time, Bitcoin’s put/call ratio sits at 0.88.

Despite the negative sentiment, the investors should have in mind that Tesla hasn’t sold most of its bitcoin holdings. The company revealed that it had purchased $1.5 billion worth of BTC and soon announced that it would start accepting BTC which was a major catalyst that helped Bitcoin rally past $60,000. During the first quarter of the year, Tesla revealed that it sold $272 million of its BTC investment which was worth over $2 million at that time.

While the car manufacturer no longer accepts BTC for vehicle purchases, Musk specified that the company will still hold the cryptocurrency on its balance sheet while searching for other environmental friendly alternatives:

“We are looking at other cryptocurrencies that use <1% of Bitcoin’s energy/transaction.”

The Elon Musk-led vehicle manufacturer Tesla sold 10% of its BTC holdings after the recent billion-dollar purchase of the number one cryptocurrency in 2021. In the earnings call, Tesla stated that it sold $272 million worth of BTC in the first quarter of 2021. The price of the coin increased since the acquisition with the company’s BTC value growing to $2.72 billion which indicated that the company sold 10% of the holdings.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post