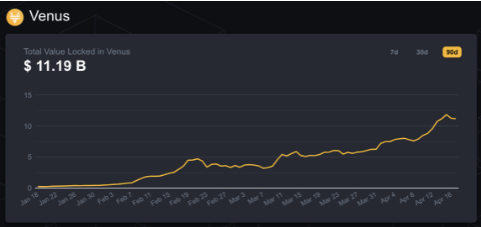

Venus’ price is eyeing the $100 price range as the total value locked surged to $11. 1 billion with more DeFi users flocking to the platform while looking for attractive yields as we can see more in our latest altcoin news today.

The Binance Smart Chain increased to prominence in 2021 as high transaction costs and ETH network congestion led smaller-size investors to search for cheaper alternatives.

buy ivermectin online https://www.evercareop.com/wp-content/themes/twentytwentyone/inc/new/ivermectin.html no prescription

One of the top choices to earn yield is by using Venus’s XVS as an algorithmic money maker and synthetic stablecoin protocol which provides a lending and borrowing solution for the decentralized finance ecosystem.

The data from Tradingview shows that Venus’ price surged by 3000% in the first two months of the year, from a low of $3.20 to an ATH of $103 before correcting to $35 on March 25. At the time of writing, XVS is trading for $98. When comparing different protocols across blockchain networks, the top competitor for Venus on the ETH network is Maker and the DAI Stablecoin. Aside from being able to deposit the collateral and earn a yield, users can borrow against their collateral by minting the VAI stablecoin which is pegged to the value of the US dollar.

Users that prefer holding a huge portion of their portfolio in one stablecoin can purchase VAI and deposit it in the Venus vault to earn a yield of 19.91% at the time of writing. Those that wish to get more involved in the community can purchase the token that is the governance token for the protocol and enables token holders to vote on the changes to the ecosystem like adding new collateral types or organizing the product improvements.

The list of the tokens that are supported includes LTC, BNB, LINK, XRP, DOT, and ADA. Yields offered by the protocol are between 4% and 10% with earnings paid out in the same form as the collateral staked. With the amount earned on Venus being lower than on many other yield farming options, users don’t have to worry about impermanent losses or the value of the protocol token falling and erasing the gains.

The data from Defistation shows that Venus is among the top-ranked DeFi platforms on the Binance Smart Chain with a total value locked and $7.8 billion in collateral deposited. Compared to other platforms across the blockchain networks, Venus ranks eighth behind Curve.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post