The BTC miners dumping half a million of their coins cannot deny the bull rally with the price still fighting to break above the $60K per coin as we can see more in our latest bitcoin news.

Things could go even higher because the BTC miners dumping half a million coins on the market during the bull rally is not making a dent in terms of price drops as the miners might have given in and started holding their coins for a new surge ahead. Bitcoin isn’t an asset to invest in and that’s it. it is also a blockchain network and a cryptocurrency ecosystem with the potential to become digital gold. The leading cryptocurrency by market cap emerged as a stimulus asset and thrived in the current economic environment.

Since the pandemic began, all efforts to thwart economic impact resulted in heavy money printing, and the crypto’s price per coin skyrocketed. From the onset of the pandemic until now, the coin increased to more than $61,000 from the lows of $4000. Recently, the miners started dumping BTC all along and in total, they poured more than 666,000 coins into the market during a time when only a few sellers started selling their coins and the exchanges continued dwindling.

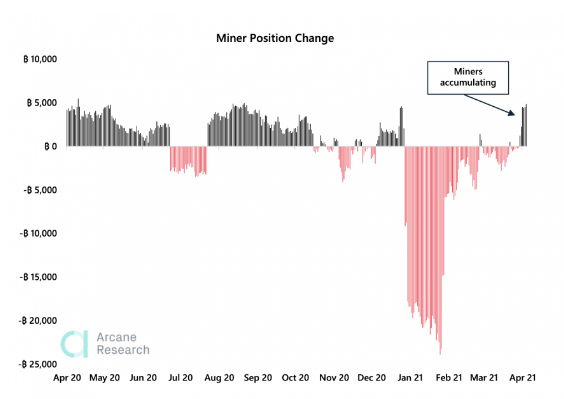

With so much supply coming in from the miners, the uptrend continued higher and the selling pressure had almost no impact during the FOMO Buying. Something that happened since caused miners to start holding BTC again and accumulate reserves for what is expected markup. According to the Miner Position Change charts from Glassnode, miners increased their positions in BTC after offloading what they were able to during the rally.

The price remains at a huge distance from the local highs and suggests that the miners are expecting even more increases in prices and plan to sell their coins later on instead at these levels. The miners represent a huge role in supply versus demand which is a dynamic that is in favor of the demand right now. The mining process is quite energy-intensive so to fund normal operations, the miners have to sell BTC or tap into their cash reserves if they have them. The miners that sold more than 666,000 BTC should put these operations in a healthier position to hold for what is ahead.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post