Alpha Finance lab surges after the new integration with Compound and the Binance smart Chain which triggered the 85% rally in the ALPA token, as we read more in our altcoin news today.

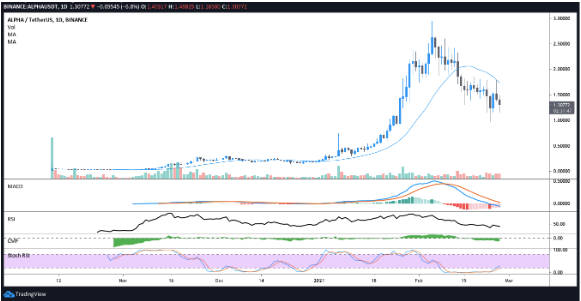

Alpha Finance lab surges thanks to the new price breakout that was spiked due to the new partnerships and the renewed interest in the cross-chain DeFi platform. The data from Tradingview shows that right after the announcements, Alpha surged to $1.78 but with bitcoin struggling to hold $50K as support, led to a sell-off among the altcoins with ALPHA trading at $1.31. One of the reasons for the sudden surge was the announcement of the partnership with Compound Finance that will allow the COMP users to integrate with Alpha Homora and to lend assets across platforms.

Impressed with Binance Smart Chain (BSC)'s growth and traction.

Hope to join the party soon 😉@binance #BinanceSmartChain https://t.co/9NT7tkAs8q

— Alpha Finance Lab (@AlphaFinanceLab) February 20, 2021

Due to the APY Deposit on Ether being higher on Alpha Homora, COMP users are now presented with an opportunity to yield farm by borrowing ETH against the collateral in the accounts and lend it out on the ALPHA protocol. Alpha was benefiting from the recent integration with the Binance Smart Chain that was growing in popularity because of its low-fee alternative to transact on the ETH network. The team at ALPHA hinted at what’s planned for the protocol while acknowledging the recent progress on the Binance Smart Chain.

After the launch of Alpha Homora v2 on February 1, we saw the release of a limited edition NFT and the protocol continued to expand its reach and to establish new integrations with the partners in the booming decentralized finance space. The project received a boost of optimism after an agreement that was reached on terms of how Alpha Finance will repay Cream Finance for the lost funds in the Alpha Iron Bank exploit back in February which involved a hacker draining $37 million from the protocol.

Compound Finance is the third-ranked Defi protocol by total value locked and the partnership between it and Alpha Finance will further the growth and exposure to new users in the following months ahead. As reported before 2021 started, As a newcomer in the DeFi space, ALPHA finance surged x10 in December only and became a very hot choice for the investors. ALPHA Finance Lab shot from a low of $0.02 in November to a high of $0.29 three weeks later during the strong spikes in trading volume.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post