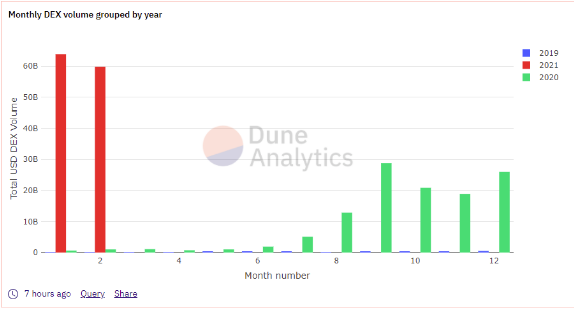

DEX Volumes surge above $120 billion as the volumes on ETH hit $63 billion alone in January, smashing the previous record of $28 billion so let’s read more in our latest crypto news.

The ethereum-powered decentralized exchanges are surging despite the high transaction fees as they are processing more than $120 billion in 2021 so far. According to the ETH market analytics platform Dune Analytics combined with the DEX volumes reached a new record of $63 billion while February’s volume sits at $59 billion and will likely hit $67 billion in the month ahead.

DEXs have already processed more volume in the first two months of this year than in all other years combined. The Ethereum-powered DEX sector is dominated by Sushiswap and Uniswap who account for about 60% of the trades done in February combined. Uniswap is now representing double the Sushi volume data controlling about 50% of the DEX market share. However, if you look at the weekly number of active traders on each platform it will show that Uniswap represents more than three-quarters of ETH dex users. in the past week, about 142,000 unique wallets traded on Uniswap and 1inch DEX aggregator followed by 18,450 traders as well as Sushiswap with 8,911.

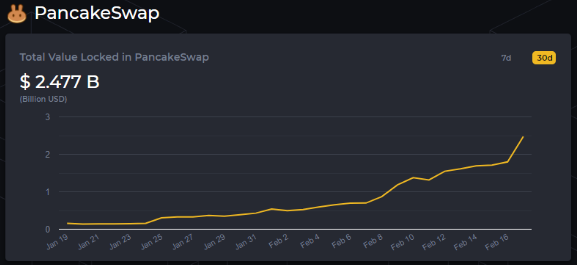

Not all DEX trading activity is happening on ETH with the Binance Chain Pancake Swap surging to a daily trading volume behind $1.1 billion, as per the data on Coingecko. As DEX Volumes surge above, some users migrated from the ETH-based DEXs but the confidence in the sector is at an all-time high with the total value locked in these exchanges surging above $40 billion for the first time in the past week.

As recently reported, PancakeSwap is now the biggest decentralized exchange by trading volume according to the data from Coingecko. The project was launched on the Binance Smart Chain in 2020 but a few paid attention to it at the time. The last day saw more than $1.7 billion traded on Pancakeswap while Uniswap saw over $1.6 billion exchange hands. The latter was based on ETH and the fees alone for the miners as per the ETH Gas station. Listed on the project are 210 verified crypto assets over 799 different trading pairs and WBNB/BUSD is the most traded one with $454 million in volume with BAKE, BURGER, CAKE, and other tokens raking up huge volumes. Users can stake their CAKE and collect SYRUP which is the platform’s governance token in turn for providing liquidity across different crypto pairs.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post