Two whales withdrew over a billion dollars from Coinbase and now rumors started emerging whether that was Michael Saylor because he did say he planned to buy $1.05 billion in BTC so let’s try and find out more in our latest Bitcoin news.

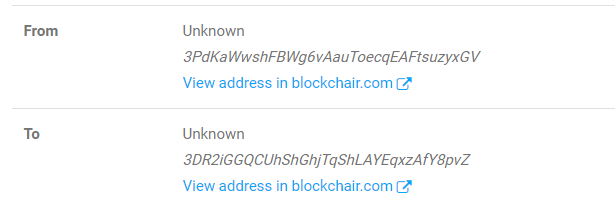

The comparable amounts of crypto were leaving other wallets as of late and the transaction comes amidst the eventful week for BTC which hit a new ATH of $57,808. Today, 13,204 BTC left Coinbase for unknown wallets which are over three-quarters of a billion dollars at a current price. According to Whale Alert, 36 separate transactions were made and each one was valued between 351 and 391 BTC in about an hour. Whale Alert tweeted that 4501 BTC left Coinbase for an unknown wallet which means that over the past 24 hours, a billion dollars worth of BTC was transferred out of Coinbase but it’s not known whether the transactions are related, the only information was that it was two whales withdrew them.

🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 2,900 #BTC (161,506,684 USD) transferred from unknown wallet to unknown wallet

— Whale Alert (@whale_alert) February 22, 2021

It could be over a counter desk reshuffling the wallets while a BTC-billionaire moving cash to cold storage or it can even be a money-laundering scheme. It’s hard to tell as the transerrer protected the privacy well and generated a new address for each transaction. This is not the first time a huge Coinbase movement happened this month.

Back in January, over 15,200 BTC worth $500 million at that time, were transferred out of Coinbase Pro and CryptoQuant’s CEO Ki-Young u said that he put it down to OTC trades from institutional holders saying:

“I believe this is the strongest bullish signal.”

Those who have been following the crypto news over the past day will know that BTC passed a few milestones as Tesla disclosed that it purchased $1.5 billion in BTC so assuming the company didn’t sell anything, Elon Musk’s electric car company will have made a profit from the purchase alone more than it did by selling cars in 2020. Another wave of huge interest came from asset management company BlackRock whose CIO Rick Rider announced the company will invest $8.67 trillion into BTC.

BlackRock is not the first asset management company to do so as Guggenheim already did with its CIO upgrading his Bitcoin price projection to $600,000. BNY Mellon which is one of America’s oldest banks announced that it will add crypto asset management services for the clients. Michael Saylor announced that Microstrategy will sell $1.05 billion in debt securities to purchase more BTC as well.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post