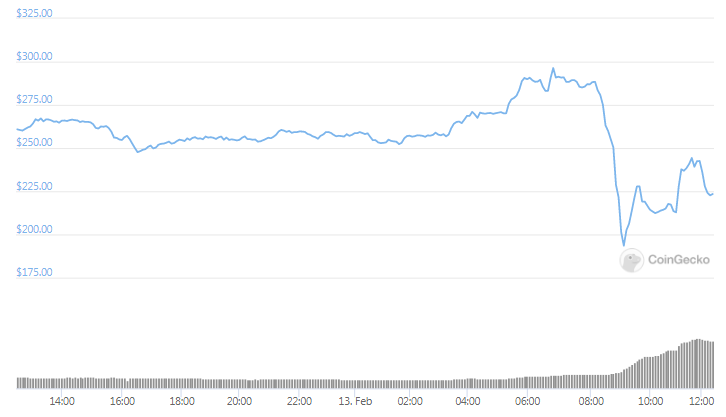

CREAM finance was exploited recently and as a result, the price for the token dropped by 30% in less than a few minutes so let’s read more about it in today’s altcoin news below.

The popular DeFi protocol CREAM Finance was exploited which eventually resulted in the token price dropping by 30%. The protocol is one of the more popular projects in the field for Decentralized Finance and it was exploited today with the price of the token crashing a few minutes after the news broke out. The official Twitter account of CREAM finance revealed the news:

“We are aware of a potential exploit and are looking into this. Thank you for your support as we investigate.”

We are aware of a potential exploit and are looking into this. Thank you for your support as we investigate.

— Cream Finance 🍦 (@CreamdotFinance) February 13, 2021

There’s no official confirmation yet but many in the crypto space are speculating that the attackers managed to steal about 13,000 ETH which is a little less than $24 million. A few hours ago, a user shared that someone is doing arbitrage of the Irob Bank contracts of Cream Finance and determined:

“Looks like a hack. Looks like they have made off with 13K ETH and they have started sending several ETH through Tornado Cash in addition to 1,000 ETH to Alpha Homora Deployer, 1,000 ETH to Cream Finance, and 100 ETH to Tornado’s grant.”

As reported recently, The Malta-based trading platform decided to list the CREAM/BNB pair as well as the CREAM/BUSD trading pair according to the announcement. This enables the users to deposit and trade their CREAM tokens against Binance Coin and the US-regulated stablecoin BUSD. The trading pair surged by about 54% in the just three hours of trading after the announcement was made. The pair hit an intraday high of $120 and the gains also came after the prolonged price action on the market. CREAM shoots up after the weekly rally of the lows at $0.001 to as high as $279. The upside move took cues from the market craze in the DeFi space.

CREAM is a part of the decentralized lending platform named Cream Finance and serves as a governance token for the protocol that users are able to use as a permissionless borrow or lend service. Rather than the interest rates being set by individuals, CREAM determines them “algorithmically based on the proportion of assets lent out.” The project grew into the conscience of yield hunters after binance decided to support the protocol of the newly launched blockchain Binance Smart Chain. This protected CREAM finance from the ETH gas fees.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post