Tesla’s investment has just put Bitcoin’s market cap en route to $1TN while many found the prediction made by Plan B in his bullish paper “Modeling Bitcoin Value with Scarcity” back in 2019 for the same level, crazy. Following the latest developments, this prediction seems to be closer than ever so let’s read more in our latest Bitcoin news today.

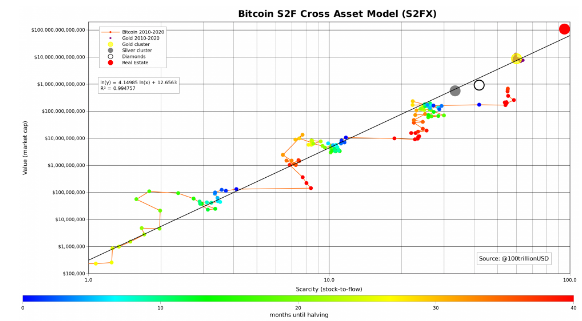

Plan B noted that certain precious metals like gold have maintained their monetary role because of their costliness and the limited supply rate and he applied the same argument to BTC which is now more valuable as a programmed algorithm that reduces the supply by half every four years to mint 21 million units. PlanB also plots the Stock to flow model against the US dollar market capitalization alongside two SF data points for gold and silver. The paper concluded that BTC’s price will rise because of its decreasing supply against the abundant dollar.

In the meantime, both gold and silver work as benchmarks to prove the BTC price trajectory. The paper predicts a $100K valuation or higher for the benchmark cryptocurrency which could push the market valuation to over $1 trillion in the long-run. The skeptics questioned the PlanB prediction given the global economy and its worth of $100 trillion. The bulls cannot expect the investors to leave valuable assets behind and to reallocate their capital into the BTC market. Some argued that BTC is not as scarce as its fans project with the code remaining replicable and serving as the base for other copycat cryptocurrencies which makes BTC anti-scarce.

buy cialis black online http://petsionary.com/wp-content/themes/twentytwenty/inc/new/cialis-black.html no prescription

Tesla’s investment into BTC also serves as a retort to the “demand” argument as the carmaker purchased $1.5 billion worth of BTC and previously reallocated 10 percent of the total cash reserves. PlanB discussed the same two years ago:

“People ask me where all the money needed for $1tn bitcoin market value would come from. My answer: silver, gold, countries with a negative interest rate (Europe, Japan, US soon), countries with predatory governments (Venezuela, China, Iran, Turkey, etc.), billionaires and millionaires hedging against quantitative easing (QE), and institutional investors discovering the best performing asset of last 10 yrs.”

Bitcoin’s market cap hit $874 billion after Tesla made its announcement which made PlanB’s price prediction the most accurate in the past 10 years across the financial sector. Mike Dudas who is the founder of the Block wrote:

“Bitcoin crosses $1 trillion in fully diluted market cap at a price of $47,619. We are 97% of the way there.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post