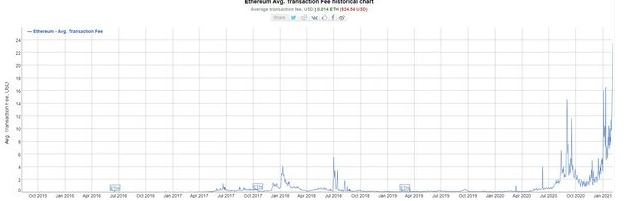

Ethereum’s gas fees surge as the coin hit a new all-time high of $1700 as we can see more in today’s Ethereum price news.

The DeFi projects and stabelcoin usage boosted Ethereum’s gas fees to a record level and with the ETH’s increasing price, it only got worse. The transaction cost paid on the network prompted the Defi and the stablecoins to surge to a new high of over $20. It’s not a secret that the community uses Ethereum as the most utilized blockchain but it did struggle with scaling issues for quite some time. Until the anticipated 2.0 arrives, plenty of other projects offered Layer 2 solutions to reduce the load and to decrease the transaction costs. This is however to no avail so far as the gas fees skyrocketed again.

According to the data from BitInfoCharts, the average transaction fees on the network reached an all-time high of $22. This is a stunning increase by more than 10x since earlier this month when they reached .

buy vibramycin online https://www.arborvita.com/wp-content/themes/twentytwentytwo/inc/patterns/new/vibramycin.html no prescription

The average fees could be only set at $22 but the community outlined other situations of absurd gas costs per transaction while others presented more compelling cases with up to $5000. The transactions experienced plenty of delays as the ETH mempool has about 180,000 pending transactions.

Almost 5k is the price to accept a bid on @rariblecom now!! 😂 Is it because of ETH high gas fees⛽️ or some type of bug 🐜 ? 🤔

Thoughts ? pic.twitter.com/tYoV1ilB85— Olive Allen (@IamOliveAllen) February 3, 2021

What came rather unexpectedly, Uniswap accounted for the bigger share of the network congestion and paid fees so users that swapped coins on the popular decentralized exchange spent about 26,400 ETH in the past month which amounts to about $33 million. Tether, on the other hand, came in second with 19.2K ETH and other Defi projects followed including 1inch exchange with 5K ETH and SushiSwap with 3K ETH. The positive outcome is that the SmartWay Forsage scam dropped to 16th place with 1200 ETH spent in the past month.

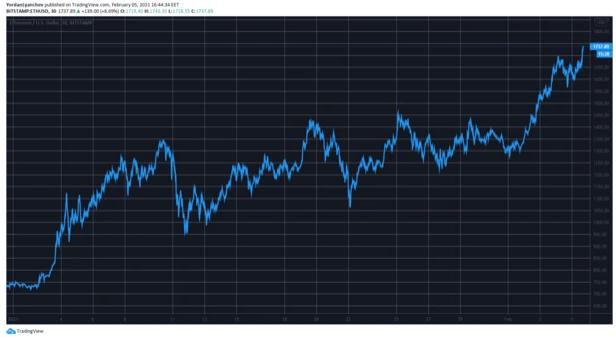

Mimicking the network fees, the ETH price also recorded new highs. The second-biggest crypto topped $1700 and its latest all-time high came at over $1740. This means that there was an increase of $500 while ETH is even more impressive as it surged by about 130% in five weeks. Ethereum’s total market cap rose to $200 billion which placed the cryptocurrency as the 45th biggest asset as per AssetDash data. Ethereum’s gas fees surge nonetheless.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post