More capital will likely enter BTC as the technical bias conflict on the market is looking to the on-chain indicators which are mostly favoring the bulls as we can see more in our latest bitcoin news.

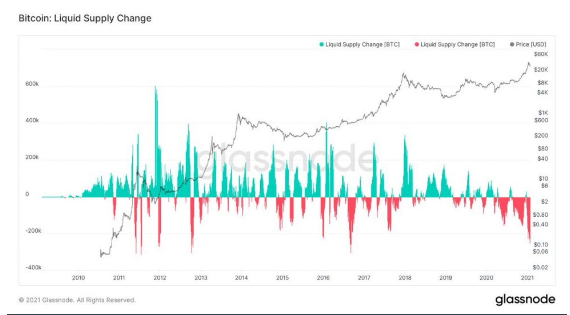

Leisl Eicholz who is an analyst at the blockchain analytics platform Glassnode mentioned a few upside cases for BTC including the Stablecoin Supply Ratio which signs a rally ahead on the market and that more capital will soon enter the BTC market. The SSR is actually the ratio between the BTC supply and the supply of the stable coins that are denoted in BTC. Glassnode noted that if the SSR rate is low, the stablecoin has more buying power to purchase BTC so from here, a high SSR reflects on a building of more selling pressure on the market. Eichholz noted:

“BTC’s SSR has been declining in 2021 as more stablecoins are minted. When SSR is low, this means that there is a large supply of stablecoins relative to BTC, which indicates more buying power ready to flow into BTC and other assets.”

The statements came out once journalists put more questions over the credibility of Tether’s stablecoin which covers more than 80 percent of the total BTC trades on all exchanges. The supply cap surpassed the $26 billion mark which means that iFinex holds about $26 billion in their accounts to maintain the dollar peg. The company avoided third-party audits and remains entangled in a legal battle with the New York Attorney Journal for mishandling customers’ funds and not backing the stablecoin with actual dollars. Amy Castor who is an independent journalist noted:

“No government agency is overseeing Tether and making sure they behave properly, which is why Tether and its sister company Bitfinex have been for years doing whatever they want.”

BTC bulls ignored the Tether controversy as the stablecoin continues to get more traction across exchanges for accelerating the traders. This supports the Glassnode SSR indicator for predicting the next trend while a lot of USDT backed or not is sitting on the sidelines to enter the BTC market:

“Many of these newly minted stablecoins are being deposited onto exchanges, meaning that they are highly liquid and ready to buy up assets such as BTC.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post