Grayscale reopens its ETH trust for private investors as it already filed multiple crypto trusts in the registry already. The risk-averse investors can capitalize on the booming crypto market with the help of the company so let’s read more in our latest cryptocurrency news.

Grayscale registered more than a dozen altcoin trusts with Delaware’s corporate registry in the past week which only shows that it is going to accommodate investors’ growing interest in crypto. Coins on the list include Aave, EOS, Uniswap, Cardano, and Polkadot. In a statement, the company clarified that it has no plans on launching any of these trusts but it wants to keep the options open. Grayscale CEO Michael Sonnenshein said:

“Grayscale is always looking for opportunities to offer products that meet investor demands. Occasionally, we will make reservation filings, though a filing does not mean we will bring a product to market. Grayscale has and will continue to announce when new products are made available to investors.”

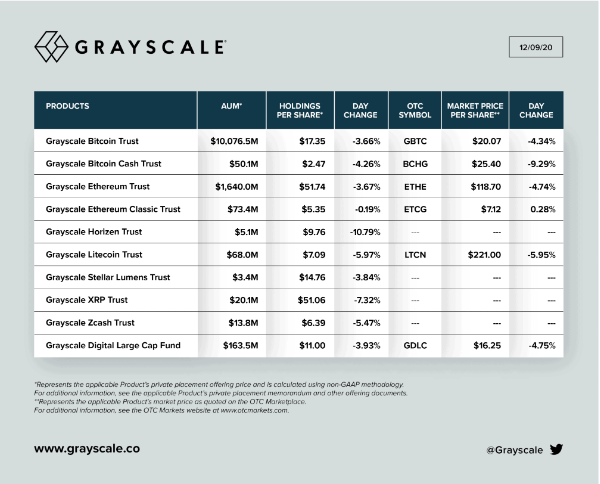

The news didn’t quite pump the altcoin market as it went in a slump yesterday as collateral damage from the Elon Musk-prompted BTC rash. However as per the announcements, Grayscale reopens its ETH trust for private investors. The ETH trust holds about $4 billion and it now welcomes a group of other private investors that will invest their money in crypto. The company will then charge 2% and sells shares in the Trust on public trading desks.

Trusts are likely to become more expensive in the near future or than the Exchange-traded funds. however, the applications for crypto ETFs on US exchanges were already rejected a few times by the US SEC. This leads investors that prefer to trade crypto through traditional investment vehicles with quoted prices and trusted legal counselors and auditors in the grayscale Trusts like the BTC trust which now has about $11.5 billion in privately invested assets.

As reported recently, Grayscale is now looking for other opportunities to start offering products that meet the investors’ demands. The company will make reservation filings occasionally though a filing that does not mean that they will bring the products to the market. Grayscale will continue announcing when the new products are made available to the investors. As such, the filings could offer a new hint of which the crypto trusts will be launched. Another registration for the Filecoin trust was also made on October 15, 2020. The New York-based Grayscale is actually owned by Digital Currency Group.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post