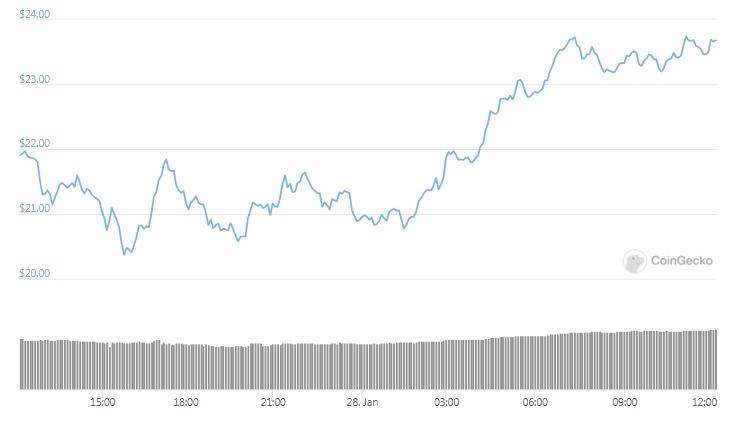

LINK holds key support at the $20.00 level whereas bitcoin and ETH had a hard time. LINK’s price is now rising and will likely rise towards $25 as we can see in our latest chainlink news.

The chainlink token price started a strong downside correction from the previous level of $25.89 high against the US dollar with the price bidding above $20.00 and the 100 simple moving average. There’s also a crucial rising channel forming with the support at $20.50 on the 4-hour charts the pair. The price is rising and it seems that it could revisit the $24.00 resistance levels as well. Recently, LINK started a downside correction from the $25.89 high against the US dollar quite similar to Bitcoin and Ethereum but with a downside break below the $22.50 and the $22.00 support.

The bears were able to push the price below the 50% fib retracement level from the upward move at the $17.20 swing low to the $25.89 high but the bulls were active above the $20.00 support level and the 100 simple moving average as well. the price then tested the 61.8% retracement level from the upward move at $17.20 swing low to $25.89 high where there’s also a crucial rising channel forming close to the $20.50 on the 4-hour charts of the pair.

LINK is rising from the channel support and is trading above $22.00. LINK holds key support and surpassed the $23.00 level, which seems that the bulls are aiming a fresh test of the $25.00 level with more gains opening the doors for a move to the .

buy zovirax generic buy zovirax online no prescription

50. if the price fails to climb above the $24.00 level, there could be another decline with initial support on the downside nearing $22.50. More losses below these levels could lead to the price of the channel support and a break below it could put the $20.00 support at risk in the near-term.

The 4-hour MACD for the pair is gaining momentum in the bullish zone while the 4-hour RSI for the pair is well above 50 levels. Major support levels are set at $22.50, $21,20, $20.60 while the major resistance levels are set at $24, $25 and $26.50. As recently reported, Polkadot, Curve DAO and Sushiswap rallied from 5% to 7% while Chainlink and Aave soar to a new all-time high. The surge in the price in other DeFi-related tokens has been a result of the increase in the DEX activity. The data from Dune Analytics shows that the DEX volumes increased since July 2020 and the total value locked in DeFi reached $23.89 billion.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post