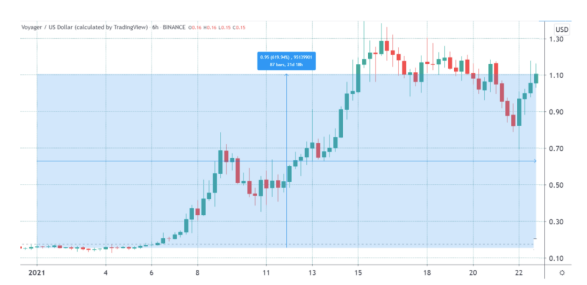

The Voyager token gained 926% thanks to the many mergers and acquisitions which brought many new users to the platform.

buy nolvadex online http://www.suncoastseminars.com/assets/new/nolvadex.html no prescription

The plans to expand in Europe led the token to rally 926% in less than a month so let’s take a closer look at the altcoin news and analysis today.

The Voyager Token is also known as BQX is the native token of the Voyager crypto exchange. The exchange separates itself from the competitors by claiming to be a commission-free broker platform and its smart order router allowing clients to trade at multiple exchanges. Since the year started, VGX gained 620% and then the token reached a new all-time high of $1.48. In addition to having a fiat gateway, the platform offers market data, crypto research, interactive charts, and 9% interest on stablecoins along with staking returns for BTC and other crypto assets if users leave them in their exchange wallets.

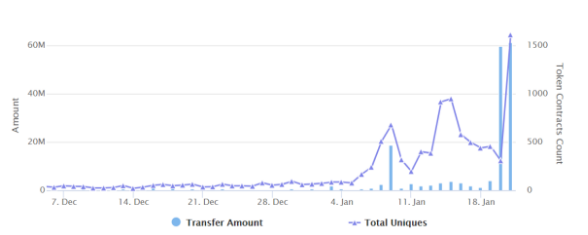

The on-chain data shows that activity started picking up a few weeks ago with the number of daily active addresses surpassing 1500 while the transfers reached $60 million. The Invest Voyager app allows the traders to earn interest with no lock-ups and the users stake a certain quantity of VGX token unlocks higher yields also, the platform is owned by a listed company in Canada that has a $600 million market capitalization.

The Candata TSX exchange listing deal has an interesting story. By acquiring the defunct shell company, Voyager managed to reverse a merger in 2019 but what’s even more interesting is not one USD was paid for the deal which involved shares of the new company. The company announced a new partnership with Celsius Network and managed to portion the clients’ assets so the broker was able to diversify the staking offering. Another notable milestone was the circle invest acquisition which converted more than 40,000 accounts.

Right now, Voyager Exchange is available to every US state except in New York. Back in October, Voyager digital acquired France-based LGO which is a fully-licensed EU digital asset exchange focused on institutional investors. LGO CEO Hugo Renaudin explained that the company will discontinue the dedicated institutional exchange while the company will operate under the Voyager brand focusing on retail.

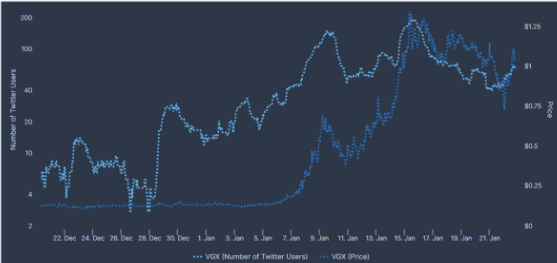

The Data From TheTIE, shows that the recent price spike was due to the increase in social network activity and apart from the users complaining of KYC-related withdrawals issues, the general sentiment of the coin is positive.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post