BTC pushes past $37K again with the rising yields boosting the bulls sentiment which is going to make bitcoin reclaim its previous critical resistances recorded over the past week as we can see more in today’s Bitcoin news.

The buying opportunities close to the $30,000 level is a level that BTC touched after it declined from the $41,986 level which renewed the short-term bullish bias of the traders. The BTC/USD exchange rate leveled a sharp retracement against the downside outlook that is caused by the appearance of the Head and Shoulder bearish pattern which gives us more hope for another move above $40K.

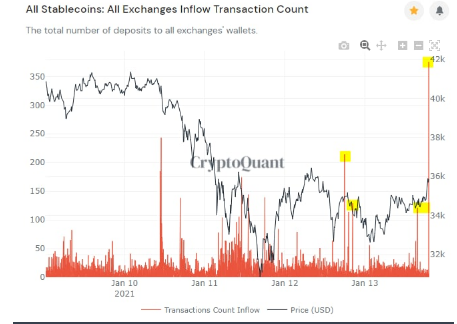

Two of the brighter market outlooks are coming from Crypto Quant which is a blockchain analytics platform that tracks BTC movements on exchanges and its CEO Ki-Young Ju asserted that the institutional investors are buying BTC between $30,000 and $32,000 which gives the cryptocurrency a natural defense against short-term dumping sentiment. This comes as a speculative guess but if the analysis is true, the bull run will protect the $30,000 level even with a dip. Ju added that BTC won’t go below $28K while Alex Saunders outlined that another chart shows an increase in stablecoin deposits on all crypto exchanges. The inflow of dollar-pegged tokens into the trading platform is equal to the potential boom in buying behavior.

The recent strength in the US dollar was a contributing factor to the weakness in the BTC market but in the meantime, BTC pushes past $37K again and the rising bond yields are adding even more downside pressure to the cryptocurrency. many analysts agree that the investors invested in riskier assets like BTC in 2020 because of the negative-yielding debt in shorter-maturity bonds and below 1% returns in long-term treasuries.

The sentimental correlation between BTC and yields proved to be troublesome as the percentage-returns of the US 10-year treasury note increased above 1% for the first time since March. The recovery started when the Democrats won the Senate last week and sparked hopes that Joe Biden will bring more stimulus to boost the US economy.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post