Terra Protocol had a successful DeFi and Stablecoin launch which was followed by a 66% rally that brought LUNA’s market cap to $200 million as we are reading more in today’s altcoin news.

This year we saw a handful of new stablecoins being launched and many analysts suggested that the stable coin growth is the backbone of the entire sector and responsible for the current BTC rally. However, for many traders, stablecoins are a safe place that offers protection during volatile periods in BTC and other altcoins but there are other ways to interact with these fiat-pegged assets.

buy clomiphene online https://gaetzpharmacy.com/dir/clomiphene.html no prescription

Terra Protocol aims to create a new programmable algorithmic stablecoin that is available on one every blockchain. Much similar to the Maker, Terra protocol has a native stabilizing crypto-asset named LUNA. the project was created by a new partnership of 15 large Asia-based e-commerce companies that have more than 30 million users. The ecosystem focuses on building efficient and competitive programmable payments. Ahead of its ICO back in 2019, the company raised $32 million in a seed financing round which included Huobi, Polychain Capital, XRP Arrington Capital, and Hashed.

Terra’s key element is the Chai payments app which has more than a million downloads on the Android store. The users can accumulate the points which can be redeemed for the merchants to the Chai partners. These partners include Yanolja, Musinsa, Megabox, and TMon. The company also offers a debit card named Chai Card that was launched in 2019 as well after it received $60 million in Series B investment round. Now, the protocol runs on a proof of stake blockchain where the miners have to stake their native crypto LUNA in order to mine Terra transactions.

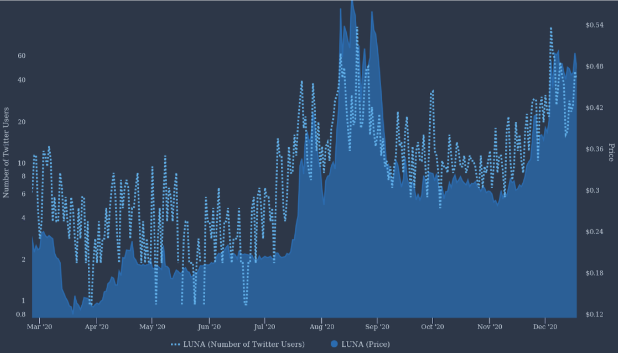

The market cap for Terra hit $150 million which is a huge milestone considering the token launched a few months ago:

“Achieves price-stability via an elastic money supply, enabled by stable mining incentives. It also uses seigniorage created by its minting operations as a transaction stimulus, thereby facilitating adoption.

buy zoloft online https://gaetzpharmacy.com/dir/zoloft.html no prescription

“

Unlike most decentralized applications, LUNA uses its own miners as oracles. Right now, the yield revenue comes from purchases of e-commerce clients that use the CHAI app. This means that LUNA token holders have bigger incentives for staking. The blockchain introduced its savings protocol dubbed Anchor which offers principal-protected stablecoin that pays interest rates.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post