BTC drops 7% right after the new all-time high price increase to $23,770 as we reported earlier today in our Bitcoin news.

Bitcoin surged to a new record high above $23,000 in the morning today but now BTC drops 7% or decreased by about $1,500. The cryptocurrency dropped from its all-time high in a matter of hours according to the data that we have today. The prices increased by more than $2000 to reach a new record high above $23,700 which was set in the first nine hours of the day. At the time of writing, the price reached $22,560 which means BTC is still up by 14.37% on a daily timeframe.

The rally is looking solid despite the losses as the derivatives market is showing no signs of overheating and the data shows there’s a strong holding sentiment. While the average level from the BTC perpetual futures funding rate on exchanges increased from 0.005% to 0.0036%, it still remains below the high of $0.093% that was seen before the price drops from November. In other words, leverage is not skewed too bullish and the crypto has chances to rally further. Calculated every eight hours, the funding rate shows the cost of holding long positions and it is positive when the perpetual trade at a premium to the spot price so this way, a high funding rate will be seen as a sign of leverage that is skewed to the oversold territory.

Furthermore, there are no signs of bigger investors that are looking to make profits with prices rallying to new highs above $23,000. At press time, there are about 2,400,000 coins that are held on exchanges which are the lowest points since August 2018 according to Glassnode, suggesting that investors are not selling off. Investors move coins usually from their wallets to exchanges when they aim to liquidate their holdings and to make a profit.

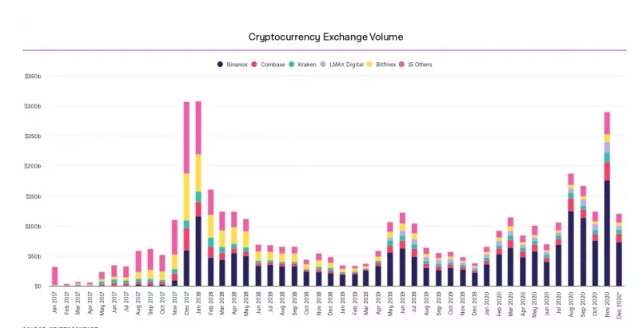

In a sign of strong holding sentiment, the exchanges balances declined by over 15% this year and took the selling side liquidity off of the market. Traders however should watch out for the spot market volumes as the liquidity could dry up during the Christmas holidays. This could also produce more wild swings in both ways.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post