ALPHA finance surges by about 1350% in the past month and started turning heads in a matter of days as we can see in our altcoin news and price analysis today.

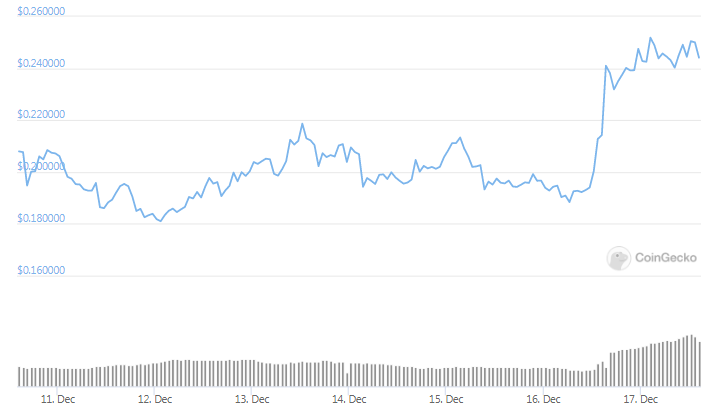

As a newcomer in the DeFi space, ALPHA finance surges x10 in December only and became a very hot choice for the investors. ALPHA Finance Lab shot from a low of $0.02 in November to a high of $0.29 three weeks later during the strong spikes in trading volume. The current price is set at $0.27 according to the latest data from CoinGecko.

The decentralized lending protocol is backed by the Multicoin Capital company and the Spartan Group. The core product is pool-based lending protocol that is decentralized and allows users to earn interest by supplying supported assets. The interest paid by the borrowers is distributed equally to lending liquidity providers as Jason Choi, the head of research at Spartan Group said, and also explained further:

“Alpha Finance Lab is a team of young and driven DeFi coders and operators focusing on shipping synergistic products. In my opinion, this is where many DeFi protocols are heading, culminating in the rise of DeFi ‘super apps…Alpha first came to market with a simple product: a way for people to lever up on their DeFi yields. With Alpha Homora, users can lever up 3x to farm assets like SUSHI and UNI.”

Choi continued that Alpha will take advantage of the DeFi composability by using Sushiswap or Uniswap protocol and therefore chose to integrate vertically products in-house. This enables even faster execution and the ease of implementing value later on. If this succeeds, Alpha could become the home of suite products that will produce fees that will accrue to all of the holders of the coin. By giving strong starts to early adopters and users, they could expect stronger network effects.

buy Buspar generic https://onlinebuynoprescriptionrx.com over the counter

The native governance token now allows users to stake coins and to earn a share of the network fees with the token also being used for liquidity mining and governance voting. The platform is designed to work across other chains like Binance smart Chain and Ethereum as well as providing support for multiple Defi assets like new partnerships with the open-source DeFi giant AAve.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post