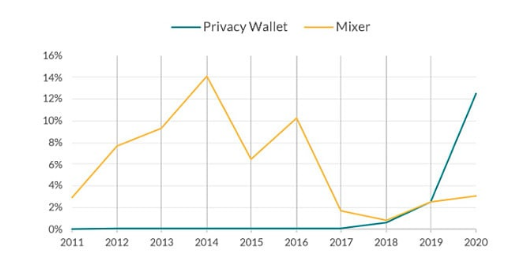

13% of BTC money laundering cases and transactions were conducted via privacy wallets especially the funds stolen from the Twitter and KuCoin hacks. Privacy wallets are seen as the perfect choice on the market for conducting illicit activities and their role is still getting popular among bad actors so let’s read more in today’s crypto news.

A recent report by a blockchain analytics company shows that criminals are using privacy wallets in order to hide their illicit BTC transactions. The usage of these wallets increased over the years and now 13% of BTC money laundering cases have proceeded through them. The UK-based analytics company Elliptic outlined in their report that there was an increase in the number of money laundering cases that use BTC but pointed out a major change in the main method of operation.

The paper outlined that most tools for money laundering used to be infamous BTX mixers but they serve as coin randomizers and are making sure that the sent and received coins are different. They also make it quite hard to trace the transactions back into the wallets.

buy nolvadex online https://hiims.in/kidneycare/assets/fonts/flaticon/new/nolvadex.html no prescription

However, they have issues as well like the possibility of law enforcement agencies seeing the mixer operators cracking down on the usage as bad actors developed a new option which is the privacy wallets.

This means that BTC Wallets that belong to certain users rather than an exchange, combined with the Tor anonymity network, can conduct CoinJoin transactions. CoinJoin is the process of creating a multi-party BTC transaction where the original source is mixed as well so it is unable to trace. The end result of the services became popular among the launderers in 2019. This year, there were a few significant security breaches that were directly related to the crypto industry. Elliptic’s report showed that privacy wallets were employed in two of the biggest hacks; the one of Twitter, and the one of KuCoin.

The report didn’t explain further how big was the portion of the stolen funds and how much of it was successfully laundered with the help of these privacy wallets. One month after the hack on the popular KuCoin exchange, the CEO said that they managed to recover about $235 million which is 84% of all funds.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post