The historic BTC charts suggest that the latest 2020 bull run for bitcoin is just starting as history repeats itself so let’s read more in our latest BTC news.

History is usually not an indicator for future performance but it is quite interesting to look at it when it comes to Bitcoin’s price and how it performed in the past. The similarity brought up by a crypto analyst showed there’s a compelling bullish cycle where BTC’s price hasn’t reached its peak yet.

buy propecia online https://nosesinus.com/wp-content/themes/twentytwentytwo/inc/patterns/new/propecia.html no prescription

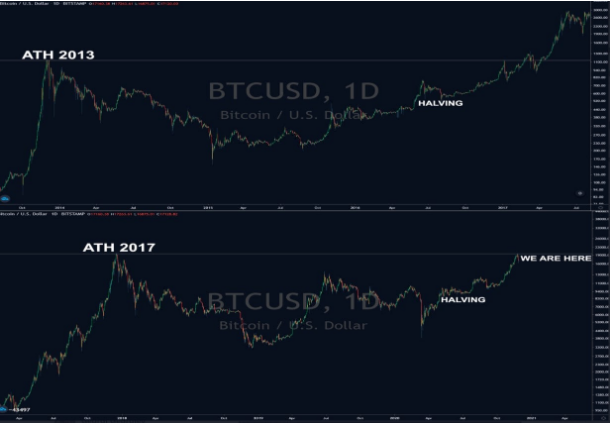

The well-known crypto advocate CryptoBull, made an interesting comparison between the price performance of BTC from the end of 2013 when it hit $1,160 to when it reached $20,000 in 2017.

As it can be seen in the historic BTC charts, after the peak in 2013, Bitcoin went into a long decline which lasted for more than a year. The price decreased continuously during 2015 and there it found some sort of a bottom and traded in a relatively tight range until September that year. The price range was set when the market reversed and BTC started increasing. The move culminated a year later in 2016 when BTC reached a high of $780 before retracing. Despite the ups and downs, Bitcoin hit a new all-time high in 2017 of $20,000.

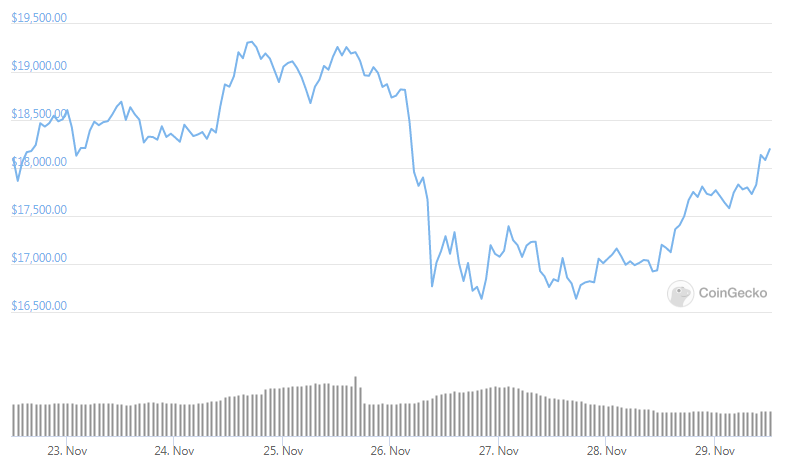

From then on, it was similar to the 2014 price movement, the prolonged bear market lasted well over a year. The price dropped to $3,100 in December 2017 and the second quarter of the following year started a reversal in the bearish trend. Bitcoin reached a new high of $14,000 in June 2019 like it did in 2016 and started declining again in a similar way. If this historical outlook serves as an indicator for future developments, it could mean that the current bullish rally is not ending soon.

The historic BTC charts show that the bull run will last longer and given that we are a few months after the last halving, the charts show that the current bull run will likely extend in 2021 and will surpass its all-time high. One thing that is slightly different was the overall awareness of investigators and the institutional involvement and bigger players in the market. The consensus for the ongoing rally is driven by institutional investors rather than the retail involvement but the difference is that the former usually invest with a clear vision as compared to the other.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post