ETH Searches hit their highest level since early 2018 and the asset seems to be burning on both Google and crypto exchanges but will it affect its price? Let’s find out in our latest Ethereum news.

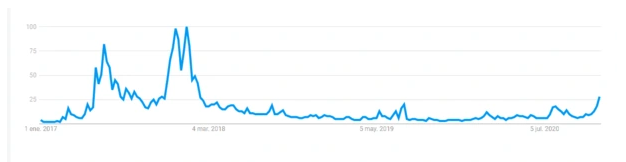

The ETH searches hit the highest levels similar to the ones in 2018 and according to the data from Google Trends, Americans were the most eager to search for Ethereum since October 2020. The popularity for the second-biggest cryptocurrency increased and reached a yearly high led by New York, California, and Washington DC.

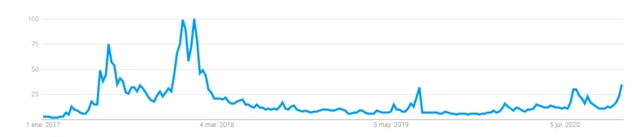

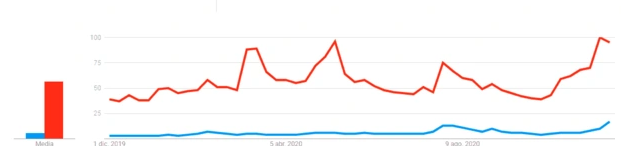

Things are similar in the rest of the world as well. The growth in Ethereum’s popularity is quite remarkable and the number of searches surpassed the 2019 levels with an even higher density of queries in Kosovo, Macedonia, and Nigeria. The interest in BTC is peaking too and other altcoins emerged in Google Trends as well. A few reasons could explain this surge and the first one is of course, the price of Ethereum. The second biggest crypto by market cap is going through a bullish cycle conquering levels that are similar to the ones 2 years ago.

Although it is still far from touching the all-time high there’s a lot of speculation about the future of ETH on the charts. Another reason is the ETH 2.0 upgrade which is undoubtedly one of the most critical events in the entire crypto ecosystem and ETH has the infrastructure where almost all of the DeFis and most of the dapps, NFTs, and other types of products run:

“#Ethereum 2.0 deposit contract stats

– Total value staked: 423,200 ETH

– Validators: 12,575

– Phase 0 staking goal: 80.7%Still 12 hours left to reach the goal of 524,288 ETH required to launch the Beacon Chain on Dec 1st.

Chart: https://t.co/EK4PNxBmSG pic.twitter.com/3582vvkZ2e

— glassnode (@glassnode) November 23, 2020”

Upgrading to ETH 2.0 will decongest the entire network and will make it more scalable. As an example, PayPal announced support for ETH transactions and described the blockchain in a very exciting way. The contact of nocoiners with events and news about it that could have sparked an interest. There’s no evidence to determine relationships between the two with the circumstantial facts that seem to point to it. An increase in prices coincides with the increase in searches and a fall with the trends that coincide with a decrease in interest in Google.

However, it’s hard to say that an increase in interest in Ethereum will cause a subsequent bullish trend or if people will look for ETH after waiting for the price to increase.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post