Charlie Lee forecasts a Litecoin resurgence now that the Bitcoin Cash altcoin is crashing, hours after the hard fork. Lee tweeted today a cryptic emoji tweet and a few of his followers replied, speculating what he actually meant so let’s try and find out more in our latest Litecoin news.

However, a few moments after the tweet, there was a user dubbed @MasterBTCLTC who gave the correct answer by replying “Litecoin Flip B Cash soon.” Lee didn’t confirm nor denied the response to his message and what’s more, there’s no logical explanation why the Chicken represents Litecoin. However, according to an analysis from CoinMarketCap, it shows that the top 10 assets there’s Litecoin in the ascendency while Bitcoin Cash crashing down, and lending more support to his interpretation. At present, the difference between the sixth and seventh place is $183 million, or about 0.04% of the total market cap.

🐓🐬🐝💵🔜

— Charlie Lee [LTC⚡] (@SatoshiLite) November 16, 2020

Litecoin increased by about 12% last week and spiked to a 12-week high at a price level of $68.50. The technical analysis noted that the formation of the major bullish trend line, with more upsides soon. Charlie Lee forecasts LTC resurgence because of the current sentiment. The analysts are targeting a new price level of $70 if Litecoin is able to maintain the momentum. Bitcoin Cash, on the other hand, is suffering a crash after the hard fork, marking a 3% drop in the price in the past 24hours. Unlike LTC which closed multiple series of higher highs since the end of September, Bitcoin Cash had a hard time gaining momentum as it only bounced off the $240 support line three times.

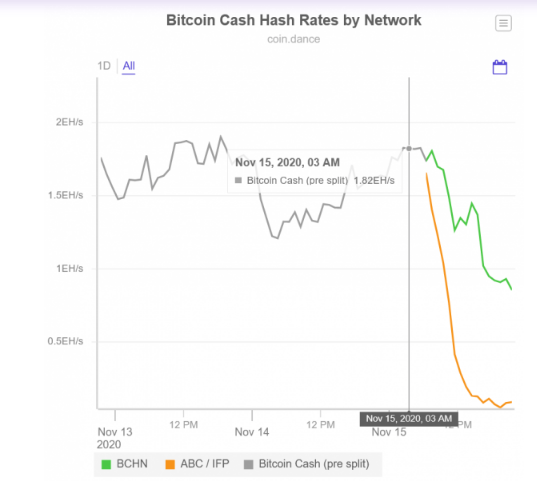

To add more to it, the future of Bitcoin Cash is in the hands of the aftermath of the hard fork that happened yesterday. The split happened because of arguments about the infrastructure Funding Plan which those in the ABC faction called for an 8% tax on miners’ profit to fund the network development. On the other hand, Bitcoin Cash node supporters felt a tax on the miners was unnecessary and believed the protocol will remain unchanged. BCH proponent Roger Ver voiced his opposition to the tax calling out the centralization issue:

“Diverting part of the #BitcoinCash block reward to pay a single development team is a Soviet style central planner’s dream come true. Please stop.”

Ver’s comments were directed at Amaury Sechet, who maintains the miner’s tax is needed as in the long run, Sechet believes the effects will lead to an increase in network value:

“This allows Bitcoin ABC to make this much needed improvement while miners who may prefer other rules are free to choose a viable, alternate implementation.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post