In our latest bitcoin news today, we can see how analysts explained why buying Bitcoin above the $16,000 is a risky investment. The executive director projected that this level of opportunity for traders to lock in some profits are is not desirable when BTC hits $16,000.

He added that opportunities would likely put the money back into the BTC market when the levels are lower warning optimists that they should not open long positions near this level. Mr. Principato explained:

“Our plan requires 3 things to unfold before we can assume any risk. First, we need to reach a predetermined level (14,250 to 13,600). Second, we need price action to produce a clear setup (chart pattern, candlestick pattern, etc.). And third, we need confirmation. Once we can measure risk and determine a favorable probability, we are prompted to share our idea and put on a new swing trade.

buy amitriptyline online https://mexicanpharmacyonlinerx.net/dir/amitriptyline.html no prescription

”

The statement followed the BTC parabolic move from $10,500 back in September this year to $16,500 in November this year. Many analysts explained that the prospects of ultra-low interest rates and infinite bond-buying is what sent the US Treasury yields lower. In turn, it prompted the investors to put more money in assets like Bitcoin. Some believed that rising the fiscal deficit which is led by the US government and the $2.3 trillion COVID-19 stimulus packs, allowed a huge chunk of liquidity to flow into the BTC ecosystem.

Some of the more bullish catalysts came in the form of institutional investments like PayPal’s decision to launch BTC buying and selling services on the payment platform. Andrew Gonci, the director at Green Bridge Investing, explained that BTC traders assumed all of the upside catalysts are what will send the price shooting to $16,500. Now, the asset is trading way about its actual spot rates which is in the overbought territory that requires a certain degree of bearish correction. Gonci added:

“Most think you are all in or all out, but if you bought 100 million of Bitcoin at 10k and it is now 160 million at 16k, you are likely to take at least 16-32 million off the table. This is how hedge fund managers think; they do not go on hopium!”

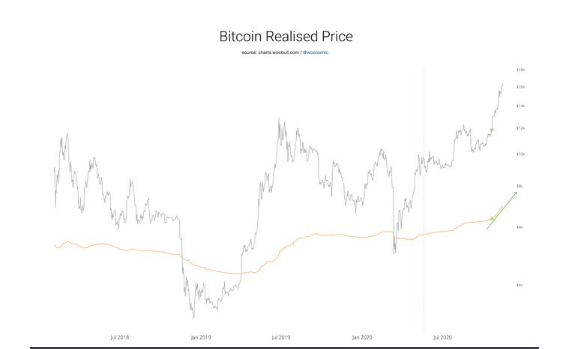

In the meantime, the on-chain analyst Willy Woo, believes that the capital is entering into the BTC market at a record pace, even faster than exiting it. He cited Realized Price which is a metric that measures the estimated average cost basis which BTC investors paid.

buy wellbutrin online https://mexicanpharmacyonlinerx.net/dir/wellbutrin.html no prescription

It has logged an “organic” upside run than the last years’ $4K to $14K move.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post