A whale just moved $14 million worth of YFI coins on one exchange as the token remains resilient today despite the turbulence over the aggregated crypto market. Bitcoin is dropping lower as most of the Defi sector is blowing up as we are reading more today in our altcoin news.

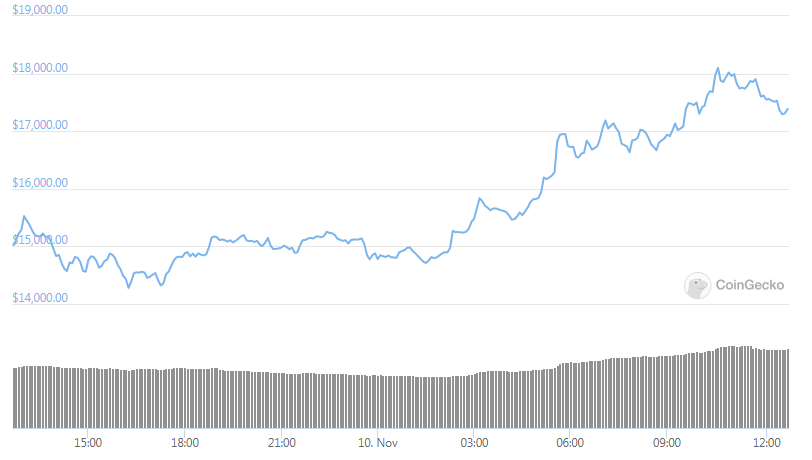

The break of the sector’s multi-month downtrend came after series of plenty of short-squeezes that are seen by the blue-chip assets like SNX, YFI, and others. A few days ago, YFI rallied from lows of $7500 to $18,000 highs in a few hours marking one of the biggest surges seen by the asset in one of its sizes over such a short period of time when a Whale just moved $14 million coins. After reaching these highs, it started encouraging some intense selling pressure which slowed down the growth and led to a sharp decline to lows of $12,000. From this point on, it rebounded and was trading sideways ever since.

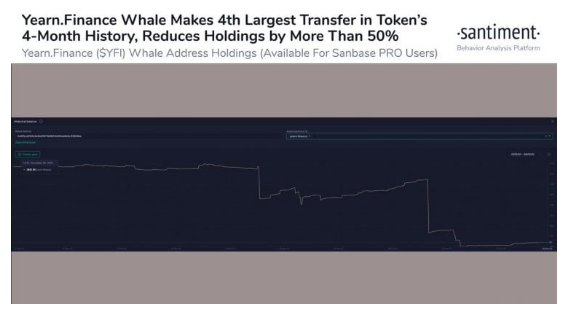

One bearish event could signal that more downsides are imminent for the token is the transference of 2,546.23 YFI tokens to a centralized exchange which marked the 4th largest transactions of all-time. The tokens could soon be offloaded and can place huge sell-side pressure on the cryptocurrency. Over the past few hours, Bitcoin’s weakness didn’t do anything to influence the Defi sector’s price action but the Yearn.Finance token traded down at 2% with a current price of $14,780. This is around the same price at which it has been trading over the past few days.

It is still down from the recent highs of $18,000 set at the peak of the short squeeze-induced rally but is up by 100% from its weekly lows. If Bitcoin goes on to the downside, it could create more headwinds that can hamper the higher-risk crypto assets like YFI. According to one analytics platform, Yearn.Finance’s YFI token saw its 4th biggest transaction ever with some sending more than 2500 tokens on an exchange. It could indicate as well that a massive influx of sell-side pressure is imminent:

“We’ve just tracked Yearn.finance’s 4th largest transaction of all-time, and highest sum since late August. 2,546.23 YFI tokens were transferred as a centralized exchange deposit, worth a total of $13.8M from a whale address to new exchange address.”

Just because the tokens are moved to exchange doesn’t mean that they will be sold but it could be a potential event that will catalyze more downwards momentum.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post