The BTC Institutional inflows for October were “impressive” according to JPMorgan analysts who think that this could be a sign that BTC is acting as an alternative to gold. In today’s Bitcoin news, we are reading more about the capital inflows and the growth of BTC.

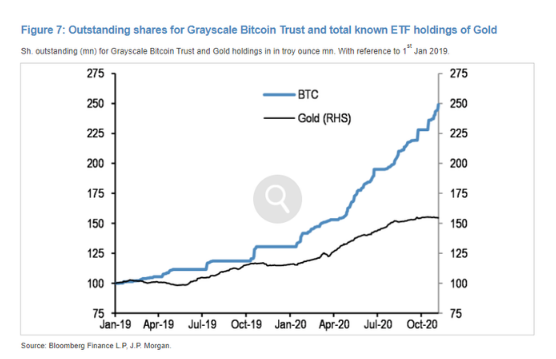

The leading Bitcoin and crypto-asset fund manager Grayscale saw a strong influx of investments over the past few months but one JPMorgan analyst believes that this is a sign that BTC will become an alternative to gold. Grayscale in the meantime, is seeing its BTC holdings explode higher. Leading BTC and crypto-asset fund manager Grayscale sent a strong influx of investments over the past few months but as the JPMorgan analysts reported, these trends are real and acknowledged. The analysts noted that the October data of Grayscale regarding their BTC trusts, suggests that BTC institutional inflows are acting as an alternative to gold. Gold has been seen as the hedge against inflation but many see bitcoin gaining steam according to JPMorgan:

“What makes the October flow trajectory for the @Grayscale #Bitcoin Trust even more impressive is its contrast with the equivalent flow trajectory for #gold ETFs, which overall saw modest outflows since mid-October…”

Driving this narrative from gold being the hedge to BTC being the hedge has now initiated a new wave of comments from prominent investors and analysts. Paul Tudor Jones said that he believes that Bitcoin is the best inflation trade in the world:

“The reason I recommended Bitcoin is because it was one of the menu of inflation trades, like gold, like TIPS breakevens, like copper, like being long yield curve and I came to the conclusion that Bitcoin was going to be the best inflation trade.”

Other analysts think that this much buying activity by institutional traders will cause another sell-side liquidity crisis as the crypto-asset trader LIGHT commented:

“A lot of the buy pressure that is competing for tightening BTC sell-side liquidity these last weeks is coming from institutionals. They are buying from people who are in the disbelief stage.”

The recent news events show that the strong buying volume is here. Microstrategy purchased $425 million worth of BTC over the past few months while Square acquired $50 million for its own balance sheet. There was other evidence regarding the large institutional players buying the number one cryptocurrency via spot exchanges as well. What’s even more important is that this “crisis” will lead to a more dramatic volume increase as the selling volume cools down.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post