In our latest chainlink crypto news, we will be seeing 3 reasons why LINK could drop by 25% again, by comparing charts.

Chainlink’s success can be seen in its market capitalization which surpassed $4.274 billion from $101 million in less than two years. The upswing pushed LINK’s price higher and is now up by more than 17,000 percent since its launch. Despite the growth of the oracle protocol, the performance of the token is exposed to the supply and demand dynamics. The exchange rate topped at $20.71 and the pair later experienced a huge selloff. The move brought its price down by about 64% as of September 23.

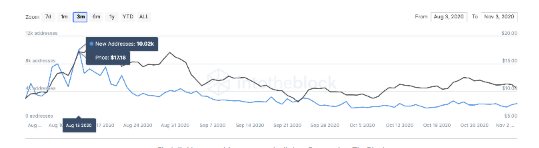

LINK’s plunge was a product of a bearish technical set up so the token bounced back and logged a 79.18 percent recovery. It remained under bearish pressure due to the combination of technical and fundamental signals that are pointed to an extended downside bias among traders. But there are 3 reasons why LINK could drop again. The first bearish setup for the coin arises from its address count. According to the data from IntoTheBlock, the number of new LINK addresses hasn’t actually moved much in the past 30 days. The chainlink network is now adding an average of 2000 addresses every day. In the meantime, IntoTheBlock reported that over 800 LINK whales with balances between 1000 to 10,000 LINK left the network before the October close.

The second reason is the solid long-term fundamentals that also fell prey to the growing BTC dominance on the crypto market during the US presidential election. More traders reallocated their capital into BTC believing that the cryptocurrency will be the winner which will benefit from the second coronavirus stimulus. LINK traders believe it is wiser to keep their funds locked in the BTC market which has hurt LINK in the short-term.

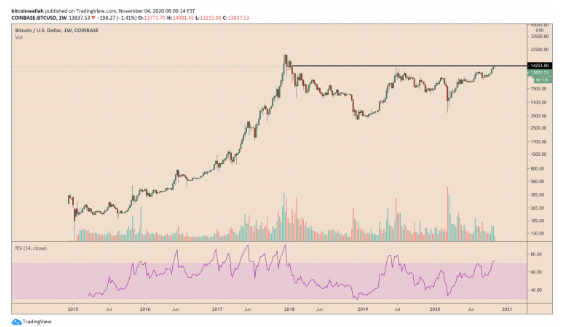

With the two bearish fundamentals lurking into LINK, the technical setup on the charts further is validating the downside outlook for the token which has to do with a “bear flag.” The bearish continuation pattern surfaces during a downtrend usually so it looks like an upward channel after the string downside movie but it could break below the lower trend line and continue heading lower. The bearish target here is as lower as the height of the pole as seen in the charts. LINK has adequate support levels even below the Bear Flag pattern. The first such of the price floors is set at $7.15 almost 30 percent lower. The second one is at $4.90 down 50 percent from the current levels.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post