Breaking below the support of $380 could send Ethereum into a tailspin movement as it faces a potential trend shift as bearish momentum was created below the $380 level so let’s’ read more in today’s ethereum news.

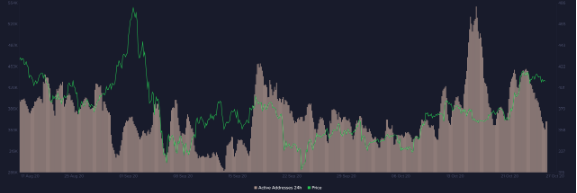

A technical break below the ascending channel trend line signaled a potential near-term trend change and the on-chain analysis shows that ETH/USD continues to face downside pressure that is followed by a decrease in the ETH activity. $80 million in ETH options expire today. Ethereum is facing strong sell pressure after the cryptocurrency failed to make the new monthly high at the start of this month which eventually incurred a heavy technical rejection from the $412 resistance zone.

Ethereum’s price has so far found technical support above the $370 support area. Breaking below the support of $380 could crash ETH’s price as it coincides with the expiration of the $80 million worth of coin options today. The on-chain data analysis shows a decreasing number of the 24-hour active addresses and signals a drop in transaction volume on the Ethereum blockchain. When the ETH/USD pair failed to trade above $420 and it was preceded by a sharp decline in the price and volume.

Data from analytics platform Santiment highlighted that from October 23, ETH addresses holding 10,000 to 1,000,000 coins dropped dramatically. This metric usually shows that the whales have been selling some of their holdings or booking profits ahead of the options expiration event as well as the upcoming US elections. It should be noted that these addresses are diametrically opposed to the addresses that hold 1,000,000 coins which continue to increase their ETH portfolios. The phenomenon will point to short-lived selling pressure on ETH.

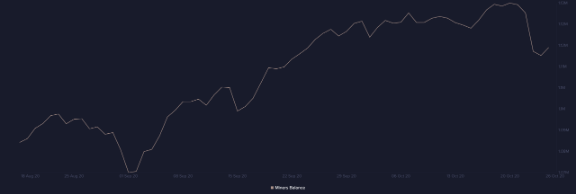

The balances are starting to recover which suggests that the miners are returning to their bullish outlook and it seems that buyers are scaling into the price dips hence the near-term support areas that have to be monitored closely as they are sensitive areas for ETH to resume bullish momentum. The technicals around ETH show that the cryptocurrency retraced back under the rising channel which should be seen as a bullish sign. The sustained break under the pattern could reinforce the selling pressure targeting $365 and $340 but if the move under $380 proves to be a false breakout, then a bounce in prices back to $450 is highly possible in the short-term.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post