The Ethereum DEX volumes drop as the Defi incentives dry up but it’s not all bad news as the price of ETH increased and the locked value in DeFi hasn’t been greater. In our ethereum news today, we are reading more on the analysis.

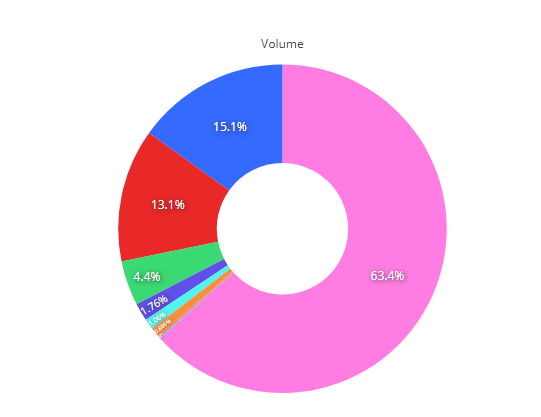

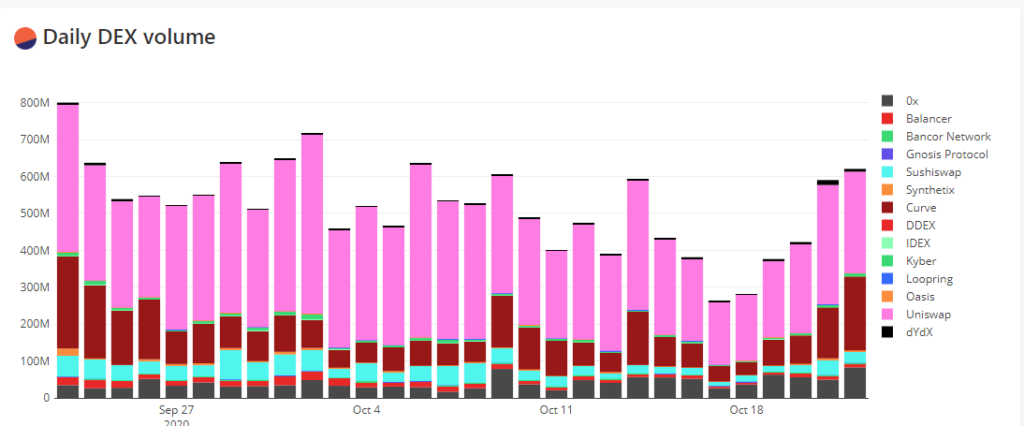

The Ethereum DEX volumes dropped over the past month and one analyst believes it’s because DeFi incentives dropped. However, prices increased. The volumes on the ETH-based decentralized exchanges dropped off a cliff this month and the trading volume got down by 41% over the most month according to the data from Dune Analytics.

The weekly trading on decentralized exchanges hit a little bit over $8 billion but later on reached a monthly high of $6 billion on September 14. The weekly trading volumes have dropped significantly to under $3 billion as the most recent data from the Dune Analytics platform shows. This marks a decrease of more than 62% since the summer peak. Decentralized exchanges are non-custodial crypto exchanges as the protocols don’t hold custody over your crypto. On some platforms like Uniswap, it’s possible to list any tokens so regulators can’t shut it down.

DEXs boomed in popularity this year during the defi boom, starting at the end of June when people invested billions of dollars into DeFi lending protocols and exchanges to take advantage of the high incentives that they offered to users with more than 1000% yields some of the time. The boom was not meant to last so to keep the magic going, protocols offered more incentives to entice people to use their platforms but many didn’t stick around once the protocol ran out of money.

buy silvitra online https://nosesinus.com/wp-content/themes/twentytwentytwo/inc/patterns/new/silvitra.html no prescription

Even trading volume on decentralized exchange Uniswap dropped as well despite the increasing dominance over the market. Johnson Xu, the director of research at Huobi said:

“I believe DEX volume is highly correlated with the DeFi market in general.”

With the decline in trading volumes, Xu said that there are other factors at play but that “one of the main reasons is that people are not earning as much yield right now just because these crazy yields are not sustainable and often come with risks.” He continued:

“The market is now returning to a more rational level, thus the lower DEX trading volume. “When the market cools down a little, these yields will be adjusted accordingly to reflect market consolidation in a healthy way.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post