AAVE increased 25% on the DeFi market comeback and continues to rebound after following a massive 45 percent price crash between October 15 and 21 so let’s read more in today’s crypto news.

The decentralized finance token AAVE increased 25% and established an intraday high above $40. The latest upside movement brought the total retracement up to about 25 percent which led analysts to predict an extended bullish momentum. The pseudonymous trader said he expects AAVE/USD to hit $42 in the near-term. another analyst had a more bullish prediction for the market stating that the pair deserves to rise by as much as 200 percent in the long-run.

The upside happened most DeFi protocol projects reported recoveries in the price of their native tokens. Over the past week, the industry logged an 835 percent rebound after the six weeks of the slow price action according to the data by Messari. DeFi tokens rallied on the news of PayPal entering the Bitcoin sphere. After the global payments giant announced entry on the crypto markets to buy stores and spend cryptocurrencies, the BTC price increased by about 11 percent. the rest of the crypto market such as AAVE tailed its upside bias.

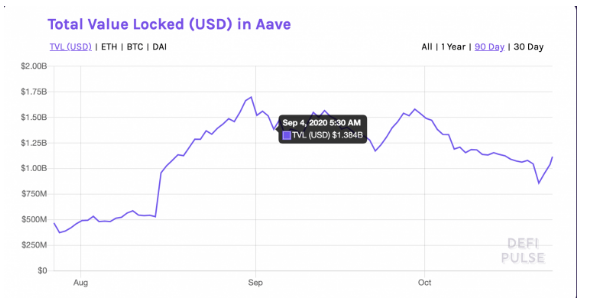

The renewed demand for the Defi assets as seen across the liquidity pools and according to the data by Defi pulse, the total value locked in the reserves hit $1 billion in the past two days. the AAVE TVL increased from $856 million to $1.1 billion. The analysts’ bullish outlook appeared because of AAVE’s parent project’s long-term aspects while Aave, the other project, attracted $25 million worth of investments.

Aave CEO Stani Kulechov noted that the raised sums will help their team build protocols for institutions and also confirm that investors will participate in the protocol’s governance and staking process which requires them to hold AAVE.

buy diflucan online http://bodypointforme.com/wp-content/themes/twentysixteen/inc/new/diflucan.html no prescription

Macro investor Spencer Noon predicted a bullish outcome for Defi projects after the US presidential election:

The likely inflection point for DeFi Bull Phase 2 is the election, where there are multiple outcomes that would be favorable for risk assets. Until then, farmers will sit in BTC[becuase] it’s low-maintenance and basically a stablecoin compared to what they were trading this summer.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post