A BNB Q3 report shows that the cryptocurrency was the best investment right after Defi as they both outpaced bitcoin for returns in the past quarter so let’s read more about the report in our Binance Coin news today.

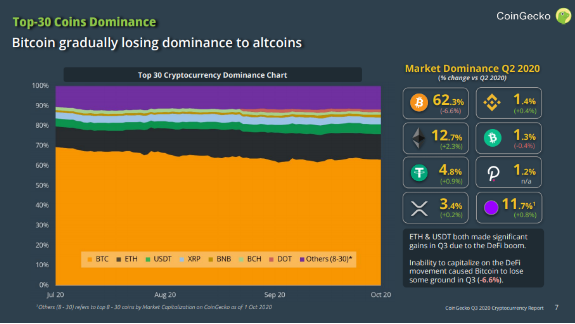

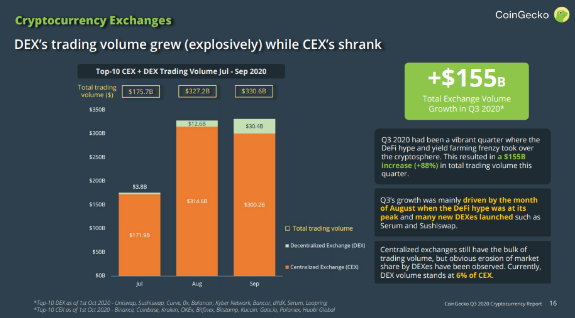

Bitcoin’s market dominance faltered despite the massive investments from Microstrategy and Square. The summer of Defi as it is called in the Coingecko Q3 report reveals many reasons for a celebration as it offers enthusiasts a few surprises. Spot market capitalization increased by 31% while Bitcoin spent most of the time above $10,000 and the decentralized exchanges stole the limelight from their centralized counterparts. Binance’s native token, the BNB token, was the most profitable crypto as the BNB Q3 report showed, with 90% positive returns. Ethereum followed behind raking positive returns of about 60% while bitcoin had only 17%,

Though Bitcoin lagged regarding the percentage, the top cryptocurrency added more to its market cap than both ETH and BNB combined. Bitcoin’s increase represents about $40,228,217,988 while BNB’s gains represent only $1,385,669,007. Ethereum’s increase was $15,207,425. However, to find the most important returns on investment per coin, you should only look in Defi. Starting with Compound back in June, the hype attracted a lot of attention or the rest of the summer.

UMA for example gained 363% in value, Aave 304%, Loopring 190%. Among the losers, you can look at Compound as it has lost about 38% of its value since the start of July. The Micro-level investors that purchased most of the Defi tokens gained more than BTC investors at the start of the third quarter of this year. however, Bitcoin’s market cap gains outperform the rest of the market by a margin bigger than $25 billion. According to the report, Bitcoin’s dominance is now on a downtrend which is interesting considering Microstrategy’s significant investments after Square did last week.

Bitcoin’s inability to capitalize on the DeFi hype caused the capital to flow into ETH and Tether but for now, there are no real conclusions to draw on the data but if the DeFi continues growing and Bitcoin remains passive, we could see Q4 with net gains of ETH and other assets being bigger than the net gain of BTC. Investors’ behavior is rapidly changing to include DEX’s like Uniswap which has become a cultural change that was unprecedented in an era of AML coming to fruition.

DEXes and DeFi protocols caused major strains on the EHT network and the community was more open to Layer 2 solutions so the developers incentivized to innovate. In September, 10% of the trade volume happened on DEXs with layer 2 adoption around the corner so the volumes are likely to increase.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post