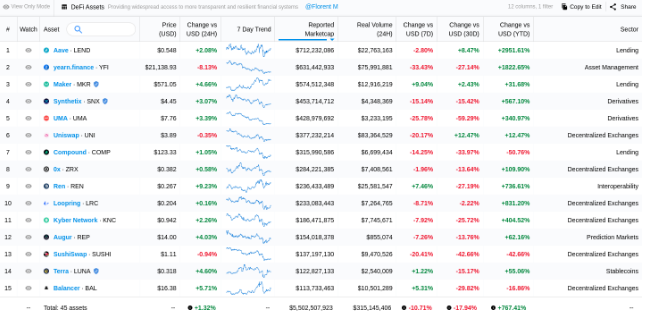

DeFi market is oversold as the pullback in the value of Yearn.finance and Aave shows it, but the increased revenue for the top projects suggests otherwise so let’s find out more in our cryptonews today.

Over the past month, the crypto market saw a huge amount of volatility as the 6-month altcoin bull market came to an end with the most recent BTC price rejection remaining set at $12,000. At the same time, the Defi sector saw an amazing run when the total value locked in Defi platforms surged above $10 billion but the sector is still in the middle of a correction. When Bitcoin and ETH started to a pullback in later September, most tokens crashed together. Then, the US President Donald Trump caught the COVID-19 Virus and the news put additional pressure on the market.

Despite this, some tokens like YFI, Uniswap, Maker and other decentralized finance tokens saw their values drop in the past two weeks. However, Various data shows that the fundamental projects in the sector are still strong. Aave, Uniswap, and Maker saw their revenues drop by 130% to 440% in the past 30 days and this happened as the prices of the tokens dropped.

It’s quite hard to measure the value of the Defi projects based on different metrics because each one is different but the two most widely utilized metrics are revenue and total value locked. The revenue shows how much capital a DEfi project is making from their products and it’s a good metric that shows the user demand and the market sentiment. The TVL shows how much capital is locked in Defi by showing investor confidence along with the share of the market. TVL is associated with the liquidity and the volume of the various staking pools.

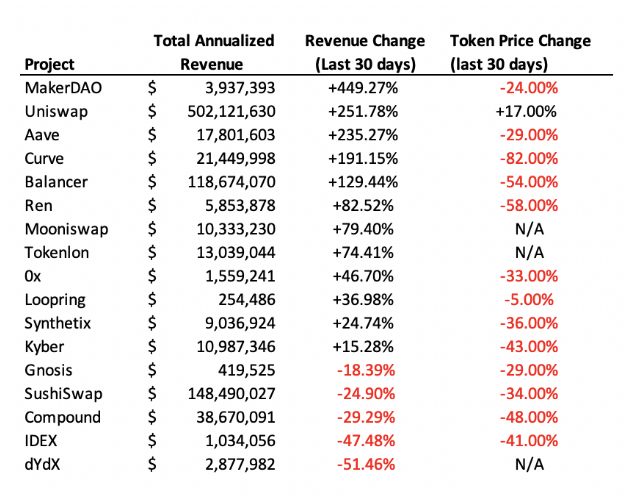

As it can be seen in the charts, over the past 30 days, the revenues on the DeFi market soared but the price of the tokens dropped by 20% and 82%. Maker dropped by 24% over the past month but it recorded a 449% increase in revenue. If a TVL of a project is stable, and the revenue increases, the major price drops only show caution on the market. Uniswap and Aave recorded a steep price drop while they both recorded more than a 235% increase in revenue. The chief investment officer at Acra Jeff Dorman, said that these fundamentals don’t move with the price:

“Price and fundamentals don’t always move the way you’d think. DeFi is a great example this month. According to data from Messari and Token Terminal, here are 30-day changes in Revenue for select DeFi protocols, compared to their 30-day changes in Price.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post