The KuCoin hacker swapped LTC for BTC on the CEX crypto exchange according to the reports by Chainalysis that we have in our cryptonews.

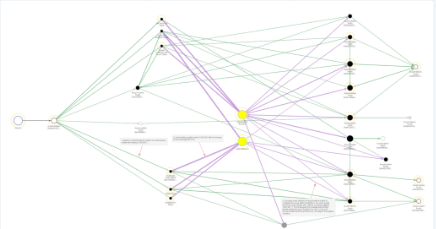

About $13 million from the recent hack were laundered through decentralized exchanges but more than $9 million went to centralized exchanges. According to the reports by Chainalysis, there were about $281 million stolen from the KuCoin hack and the hackers purchased 875 BTC from centralized exchanges using stolen coins like Litecoin. Most of the funds were laundered using decentralized exchanges.

The new report by Chainalysis sheds light on the $280 million hacks and where the funds have gone. While the hacker was mostly using decentralized exchanges like Uniswap, the KuCoin hacker swapped LTC for BTC on centralized exchanges, mainly the CEX crypto exchange. On September 25, an unknown hacker gained access to the private keys of the exchange to at least one how wallet and drained the platform out of more than $281 million worth of BTC, ETH, and other altcoins. Crypto projects like Orion, Velo Labs and Tether, moved to freeze some of the funds but the hacker still managed to sell $13.2 million through decentralized platforms. Decentralized exchanges represent an easy way of laundering stolen crypto as Chainalysis reported:

“By using DEXs, the hackers were able to swap their stolen funds into new types of cryptocurrency without having to go through regulated exchanges who had flagged their addresses and would have required them to submit KYC information.”

Some of the funds however went into regulated or centralized exchanges, Chainalysis claimed:

“The hackers have purchased and withdrawn roughly 875 BTC from centralized exchanges using altcoins stolen in the hack, including but not limited to Litecoin. Of that newly-purchased 875 BTC [$9.2 million], roughly 683 BTC has been sent to mixing services.”

KuCoin which stopped deposits and withdrawals in the wake of the attack as it worked to reintroduce services with some of its supported tokens over the week with many of them being obscure. For example, the pairs with EdenChain, WOM Protocol, NEwsCrypto became available. Users are still unable to deposit or withdrawal some major tokens like XRP and Ether. The platform’s trading volume are down since the hack while two months ago, KuCoin never dipped below $100 million in its 24-hour trading volume while now it is below $90 million.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post