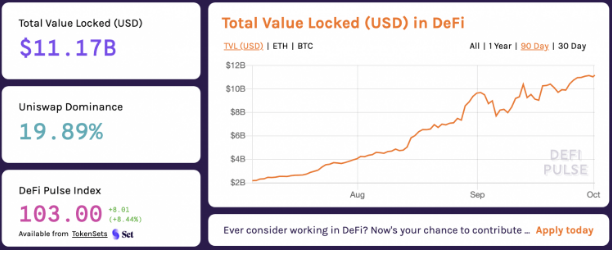

This new inflow of decentralized finance capital can propel Chainlink’s bullish momentum continuum. The whole value that is in DeFi applications has managed to go beyond $11 billion and is still going up, so let’s read more in our latest chainlink crypto news.

This is why this crypto that is extremely crucial to DeFi data can grow even more together with this fast-growing statistic. The DeFi movement that influenced the bringing back of the crypto market from its bearish momentum is in the attention of the financial world. The newfound ways in which you can access financial applications circumventing central authorities that are needed in this kind of operations opened the opportunity for different alternatives for investors with the goal of maximizing the value and return they get from holding.

Yield farming, liquidity pooling, and token swaps were the replacement for centralized exchanges together with traditional lending and borrowing. DeFi is giving this possibility through Ethereum-based decentralized exchanges and applications. This new wave started in early 2020 having Ethereum as its leader and was late overshadowed by the wealth that was made by Aave, Yearn.Finance, SushiSwap, and others.

Compound and Maker who were the first to excel on the DeFi market in total value have from then on fallen to the popularity of Uniswap.

buy apcalis oral jelly online healthcoachmichelle.com/wp-content/themes/twentytwentyone/inc/en/apcalis-oral-jelly.html no prescription

The new launch of free UNI tokens only hardened this, giving the platform the most dominant liquidity pool TVL-wise. While UNI is doing well, and the rest of the DeFi space is still holding strong, there’s another cryptocurrency that could benefit from the continued increase in TVL locked away in DeFi applications. That altcoin is none other than Chainlink.

DeFi application and automated market makers like Uniswap need correct price data in order for users can receive the current market values of any given token. These applications are relying on oracles such as Chainlink to achieve that there are no discrepancy in the data that is reported and all the connections made to it are 100% compatible in the pricing data. This technology earned Chainlink a recognition from the World Economic Forum at the start of 2020 and is one of the top reasons why the cryptocurrency is growing for two years since its initial minting.

With the new inflow in DeFi, can we expect to see the price of Chainlink shoot higher soon?

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post