Global stocks and Bitcoin declined after the ending of the Presidential debate between Donald Trump and Joe Biden so let’s see how it ended in our latest bitcoin news today.

The number one cryptocurrency deleted most of the Tuesday gains to turn 1.19 percent lower. At the same time, the futures tied to America’s S&P 500 index dropped by 0.85% hinting to open in negative territory during the New York opening bell on Wednesday. The Asia-pacific markets such as Japan’s Nikkei, Australia’s ASX 200, and China’s Shanghai Composite dropped as well. In Europe, the futures linked to London’s FTSE were down by 0.5%.

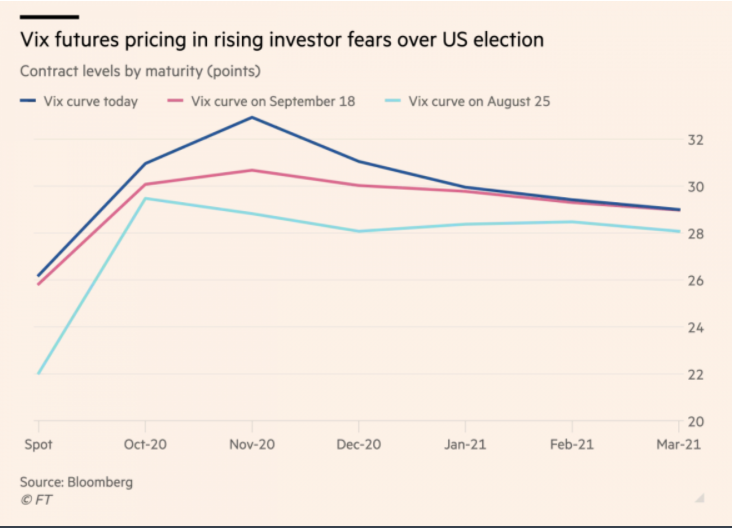

The sell-off across the markets happened as the investors reiterated their concerns over the uncertain US presidential election. The negative sentiment took cues from Trump’s comments on the widespread voter fraud and his vows to challenge the outcome. The global stocks plunged as the fears of disputed election pushed which is a barometer to gauge market uncertainty using the volatility higher. Economists and analysts predicted a further uptick in VIX ahead of the US election which leads to a short-term stock market sell-off. Mark Haefele, the chief investment officer for global wealth management at UBS said:

“[Trump’s] suggestion that he would actively contest the results for weeks after the ballots are counted increases the level of uncertainty for market participants and will likely lead to higher volatility as we approach election day.”

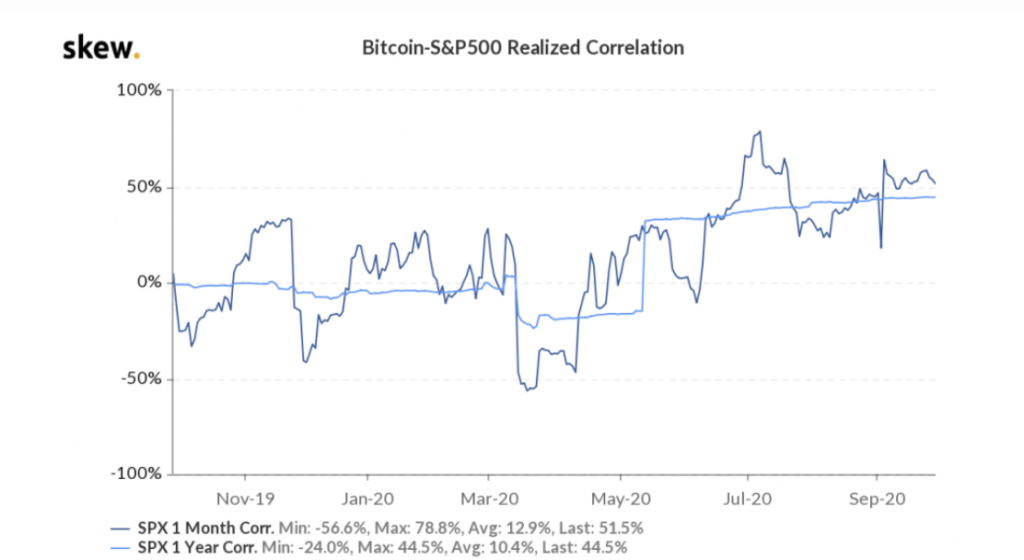

While the BTC market does not concern itself with the geopolitical setup, the cryptocurrency’s correlation with global market sentiment since the crash in March 2020 suggesting an influence. So it seems that investors with exposure in both BTC and stock markets tend to sell the asset to offset their losses across equities. The overleveraged traders use their BTC profits to fill their margin positions. That further created an additional downside pressure on the cryptocurrency.

One of the other reasons why the traders sell BTC concerns liquidity as in March the crypto crashed alongside the global stocks because the investors aim to hedge in cash. As a result the US dollar index surged 8.80 percent during the rout. The Federal Reserve’s expansionary policy and the US Congress $2 trillion COVID-19 stimulus package that prompted investors to move back to stock, gold, and BTC markets.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post