ETH mining revenue hits a five year high so the miners have to be quite happy about the astronomical gas prices. In our Ethereum news, we can see that the miners’ profits are raking up like never before.

Uniswap’s launch of the native token and the farming rewards caused a digital gold rush which has crippled the ETH network for the second time in the past weeks. The news was excellent for the ethereum miners as the ETH mining revenue hits a new high according to the on-chain analytics provider Glassnode. The mining activity pushed Ethereum’s hash rate to the highest level since October 2018.

📈 #Ethereum $ETH Miner Revenue (1d MA) just reached a 5-year high of 2,275.790 ETH

Previous 5-year high of 2,273.540 ETH was observed on 02 September 2020

View metric:https://t.co/txQ50SBsFI pic.twitter.com/RWTRP60CJX

— glassnode alerts (@glassnodealerts) September 17, 2020

At the time of writing, the hash rate hit 254 TH/s according to BitInfocharts. The last time that the figures were so high was on September 2nd when the gas fees reached another all-time high level driven by the SushiSwap DeFi food farming craze. However, this time, Uniswap’s UNI token beat the odds and put pressure on the network which was been twofold as those tokens that were airdropped UNI will likely have sold them for ETH while the prices were pumping and also there was a rush to deposit the liquidity into Uniswap’s four new pools.

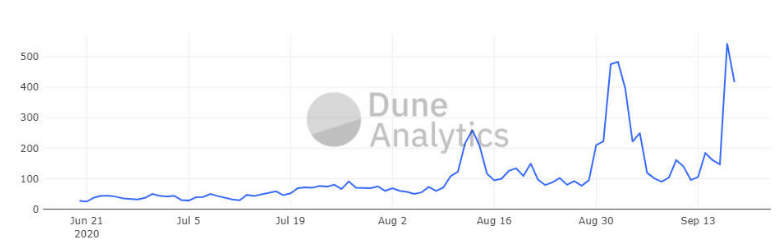

At the time of writing, the pools accumulated more than $825 million in just over a day since they were launched. Dune Analytics reported that the median gas prices surged to $544 gwei which is the highest level ever recorded. During the height of the UNI token seen a few days ago, some of the users were quoting transaction fees surpassing 1000 gwei. Bitinfocharts.com is currently reporting the average cost of an ETH transfer at $11 but this is a lagging indicator and things seem to be calming down a little in terms of blockchain activity.

The Ethereum prices have seen increases from the recent activity and many prominent members of the crypto community regarded Uniswap’s yield farming pools as a bullish sentiment of the asset. The price topped out at $390 a few hours ago and the move even added an additional 7% for the day so the asset is up by roughly 10% on the week. Since then, they retreated a little bit to the $388 zone but momentum is quite bullish so ETH could make a comeback above $400.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post