The analysts warn of things to look out for with the latest decision of SushiSwap to cut down the block rewards as the platform blew up on its promise for outsized rewards for everyone that will get into the automated market maker.

buy levitra soft online www.adentalcare.com/wp-content/themes/medicare/editor-buttons/images/en/levitra-soft.html no prescription

1000 SUSHI tokens per block for liquidity providers was the set award before the platform went live so let’s read more in today’s altcoin news.

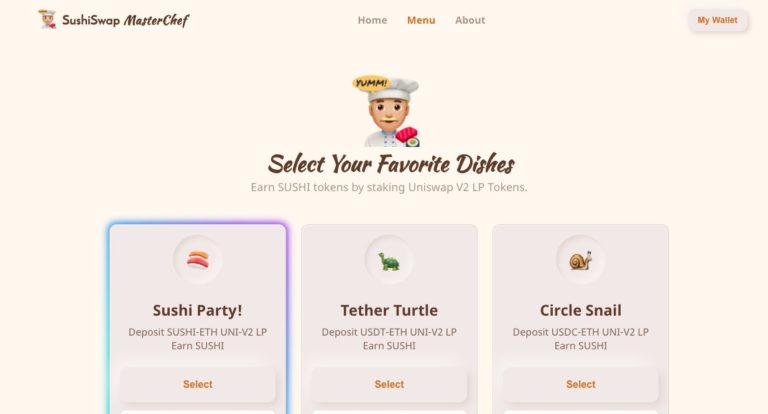

This deal seemed good enough to lure in more than $1.6 billion crypto assets but now those days of outsized rewards are over. As planned, each block reward dropped to 100 SUSHI on ETH block 10850000. Now that SushiSwap is serving up less SUSHI, it’s anyone’s guess what will happen to the piles of crypto that are locked in SushiSwap’s smart contracts. SushiSwap migrated successfully, more than $800 million in crypto assets from rival automated market marker Uniswap by using its tokens that were entrusted to the upstart project by those that sought SUSHI block rewards.

Liquidity in SushiSwap stands at $1.46 billion in crypto-assets according to the community-built block explorer SushiSwap Vision. Uniswap has $539 million according to the Defi pulse as of late. SUSHI is now trading at $2.45 as the bonuses end off it seven-day high of $3.17 according to the data from CoinGecko.

Giving away a fresh token became an obvious way for new protocols to compete with the market leaders as liquidity mining remains a category of yield farming where liquidity providers earn an additional token beyond the fees which they earn from underlying protocols. The growth hack was pioneered by DeFi lending platform Compound with its COMP governance token starting off with the cascading innovations in the upcoming months. The analysts warn what to look out for so let’s dive deeper.

Before block 10850000, each SushiSwap LP got SUSHI in proportion to the liquidity that they were supplying. So if SushiSwap had 100 LPs and they put in equal amounts of liquidity, they would get each 10 sushi per block. If this number increased to 1000 LPs, they would get 1 SUSHI each. More LP lowers yield in a mined token but it also boosts the token’s price so what is the optimal balance?

Chef Nomi, had a vision of a tokenomics where his platform will remain fixed and the main governance question will be how fast to add new pools. However, the community seems to want fine-grained control which could bode ill for the low-governance models.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post