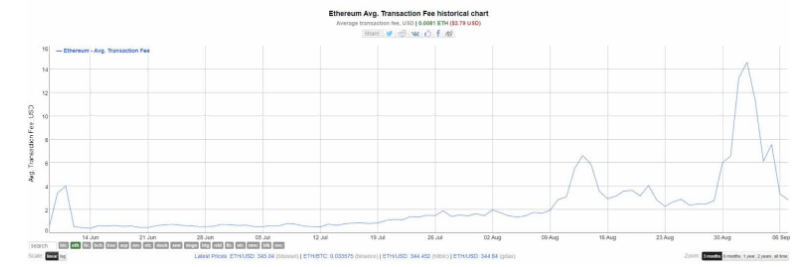

ETH fees rise again by 70% following the brief drop of the all-time highs but Defi activity keeps them from going lower as we read more in today’s Ethereum news today.

The average transaction fees on Ethereum increased to $4.55 two days ago, marking a 70% jump from two days before. The average fees were above the two dollars for more than a month which is a record-running streak.

buy amitriptyline generic buy amitriptyline online no prescription

The Defi activity boosts the elevated network activity and fees.

Even when the prices settle after the huge crash at the start of the month, the ETH fees rise again by 70% for a record-breaking streak. Ethereum transaction fees that broadcast ETH transfers or interact with smart contracts on the ETH network remained above two dollars on average fur a full month, as per the data of BitInfoCharts. At the same time, the average transaction fees increased as high as $14.58 before dropping to $2.67. The fees are rising again which is a sign that the activity on the network is picking up again as the DeFi mania is even further from over.

The fees for Ethereum are determined by the network activity and blockchain transactions are processed by the miners with limited capacity. Once the transactions are getting broadcasted to the miners, the fees increase. This gives an incentive for the miners to add processing capacity in the form of higher fee rewards while still reducing the number of transactions that get broadcasted from users not willing to pay the costs of the high fees.

The Ethereum transaction fees increased by 70% to $4.55 between September 8 and September 10 while the price of ETH also increased during that time but only about 4% to $363. The average transaction fees on ETH were sustained above the two dollar level twice before according to BitInfoCharts. In early 2018, ETH fees remained above this level for about 10 days between January 5 and January 15. The second occasion came in 2018 when Ethereum fees stood at two dollars level for a week.

The transaction volume is such that the average daily fees didn’t have a chance to dip below two dollars. With the recent reversal from the fees that were dropping, the streak seems to continue. The continued activity was powered by DeFi applications which drew in billions to be used for making loans and to provide liquidity for token swaps. The recent DeFi activity was so strong that the tokens were being moved throughout the network and surpassed the one of Bitcoin for the first time in years.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post