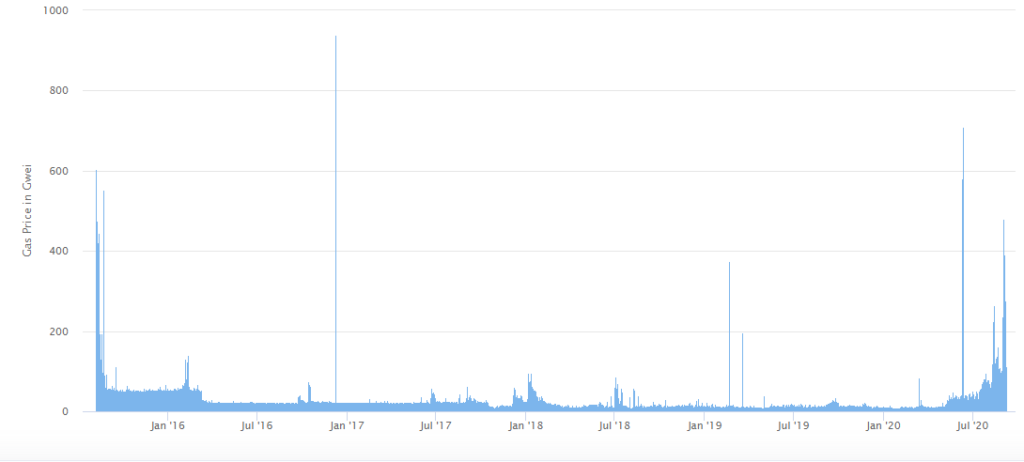

ETH developers worry that the tokenized gas could only be a price floor for bigger transaction fees and will continue on keeping them high as we are about to find out in our latest Ethereum news today.

The ethereum smart contract feature that offers rebates for the fees has the developers wondering if they will have to get rid of the old code in light of the exponential rise in transaction costs. The gas tokens are loopholes that are a way to send transactions on the cheap by “tokenizing gas” for the fees paid for running the computations on-chain. The feature will allow the ETH users to buy transaction fees when they are low and store them and spend them when they are high. With the matter still being under discussion, some ETH developers worry if the tokenized gas will act as a price floor for transaction fees in the future.

As the fees hit record highs twice in the same week, the developer Alexey Akhunov and his Ethereum Improvement proposal to get rid of the gas tokens is now getting more attention. Akhunov’s math in the Ethereum Research and developers messaging app shows that 1.5% to 2% of ETH transactions over the summer used prepaid gas tokens. Most of the traders have similar setups that the analysis doesn’t capture, according to developer Ali Atiia. Akhunov added during the developer call adding that he is still conducting analysis on the magnitude of the gas token usage:

“Transaction pools are basically like a one-sided order book where you bid for the gas prices. Those orders placed in a particular place are to make sure you buy the dips, like in the traditional two-way order book.”

Blockchains are basically data settlement layers so some data is more valuable than other data and maintaining it is a cost node that the runners have to bear. Ethereum wants to mitigate the problem by offering ETH back for deleting older contracts or information from the contracts. This as some believe is being used to lower transaction fees.

Tokenized Gas is a small script that you can run when you send a transaction so the script deletes all the previous data stored on the gas smart contract when the fees are lower. The rewards is what you get for deleting the old data. If the price of sending ETH transaction is high enough, the tokenized gas can subsidize by 50% of it which can be useful at a time when decentralized finance is pushing ETH fees to record highs.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post