DeFi pushed Binance to a massive $195 billion in futures volume level, reaching an unprecedented increase as the market exploded in August. In our Binance news today, we are reading more about this analysis.

The futures offerings saw more than $195 billion across Bitcoin and other altcoins as the exchange said that the rise of Defi projects fuelled the rush in altcoin future as well. DeFi pushed Binance to reach a volume of $195 billion across all altcoins as the company noted. Futures markets allow investors to take leveraged bets on the price movements and they also allow traders to profit from the price drops by letting them bet against the market. This is contrary to the spot trading where investors can buy and hold an asset or ell to fiat for a loss.

As one of the biggest exchanges in terms of volume Binance, reaped the benefits of the booming futures market led by the DeFi explosion, the company said it listed more than 17 futures contracts in August alone. They included Defi projects such as yield aggregator Yearn.finance YFI token and many others. The market share of the exchange in the altcoin futures space increased by 41% and stabilized between 30-45% in the past week. The exchange even marked one of the highest daily altcoin futures volume with more than $5.8 billion traded:

“A significant portion of the volume growth is attributed to altcoin contracts as traders shift their attention towards altcoins, [and] in particular, DeFi-related cryptocurrencies.”

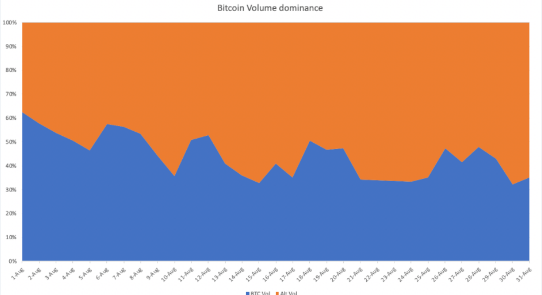

The volume on Binance futures increased by 79%, hitting $195 billion which is the highest monthly volume since its inception as the company said. In the meantime, as the altcoin volume grew and the BTC total volume dominance dropped over the period of one month. Binance explained that most of the activity in the altcoin space was attributed to investors betting on a lot more projects. Over the past month, obscure Defi projects such as Kimchi or SUSHI mirrored the efforts of Yearn Finance to offer different yield farming projects to investors which saw the latter lock up millions of dollars worth of crypto to be lent out to other traders and earn interest rates up to 100,000%.

The Rush led to the total value locked across the Defi ecosystem hit a staggering $8 billion figure and projects such as Uniswap account for over $1.66 billion.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post