The BCH price remains stuck at $268 with the upgrade being scheduled for November 15 despite the longstanding debate about the fork difficulty adjustment algorithm as we are reading more in the latest Bitcoin cash news.

Despite the controversies about Bitcoin Cash, the BCH price remains stuck at the $268 price level with the halving touching the peak price of $503 back in February. Given the fact that the start of the year started a short-term rally on the market, the crash in March came as a surprise since the pressure that was created, wiped all of the coin’s gains.

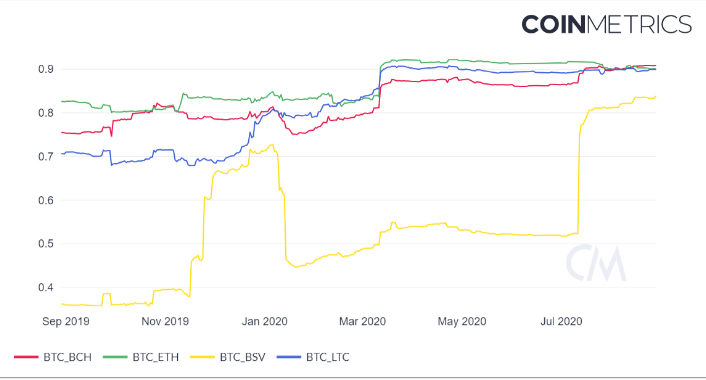

Since BCH is a Bitcoin fork, the cryptocurrency has remained highly correlated with the number one asset. As Bitcoin consolidated at press time, BCH was noting downward pressure on the charts and according to CoinMetric’s charts, the Bitcoin to BTC correlation coefficient is set at 0.9083 whereas BSV shared a correlation of 0.8339. While Bitcoin Cash is extremely correlated to Bitcoin, Bitcoin Sv is among the few coins that share a low correlation with the biggest crypto asset of the world.

Due to the push and pull in the Bitcoin Market, Bitcoin Cash’s value fell on the charts over the past few days and the chat shows the price falling within the descending channel after reaching huge volatility. The Bollinger Bands seem to have converged which is a sign of low volatility but the bearishness has just started. As the moving average and the signal line moved above the price candles, the price trend changed which means that the traders are a primer to sell the cryptocurrency as confirmed by the MACD indicator.

buy tadalista online pridedentaloffice.com/wp-content/themes/twentytwentyone/inc/en/tadalista.html no prescription

The movement of the MACD line under the Signal line was an indicator for the traders to sell the cryptocurrency which is going on since August 11 and the daily chart underlined the bearishness on the market. As Bitcoin Cash’s price went lower, it got closer to the Fibonacci retracement level of 61.80% at $273.95 and in the given time period, the level was acting as an immediate resistance as the coin hadn’t managed to breach the said level. The immediate support lays at $258 which is a level that was tested once before when the price bounced back immediately.

If the selling pressure on the BCH market falls, BCH could record a trend reversal but until then, it could keep stalling.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post