The ETH-based assets recorded highest returns this year exceeding 500% thanks to the recent bullish run building in the crypto space so this doesn’t come as a surprise. Following the latest reports that we have in our Ethereum news today, we take a closer look at the analysis.

The data obtained from the crypto data aggregator Messari, showed that the average performance for ETH-based assets and DeFi assets hit a 129% increase and year to date gain. The data provides an overview of the 178 assets that exist on ETH totally totaling a combined market capitalization of $64 billion which is about 20% of the entire crypto capitalization. The 10 ETH-digital coins posted year to date gains surpassing 500% including most of the decentralized finance protocols network and Bancor’s BNT.

Just as a reminder, Nairametrics reported how Ethereum miners profited from the huge surge in fees to all-time high but on the hourly charts the platform observed that more than a third of all ETH miner revenue comes from the fees rather than the blocks which are an increase of less than 5% in April. Like many other assets that speculating with Ethereum can become highly profitable and had a good history of giving the investors huge returns. There are other options as well to make income from Ethereum such as faucets and staking.

Ethereum miners earn a lot form the ETH fees as the data from Glassnode shows that the ETH network is much more active and sustainable compared to the 2018 start. Miners are earning record-breaking shares of profit from network fees as the transaction complexity by total gas use also increased. It’s been reported that the fees on the Ethereum network are some of the highest they’ve ever been but the data shows that the difficulty and hash rate for proof of work mining activity that secures the blockchain is down by 25% since skyrocketing in Summer 2018.

buy fluoxetine generic https://buywithoutprescriptiononlinerx.net/fluoxetine.html over the counter

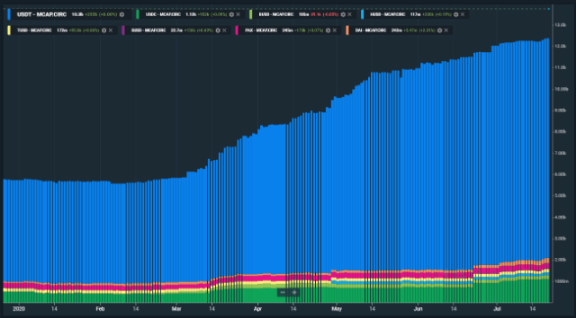

New data from Messari shows that Ethereum becomes the most used blockchain, surpassing Bitcoin as the network that settles most value per day. This means that the dollar value of transactions of both Ethereum and ETH is higher than the one of Bitcoin. While the DeFi sector started gaining a lot of popularity, the stablecoin transactions were responsible for most of the volume, reaching $508 billion in transactions in 2020. This figure is about the double of $254 billion back in 2019.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post