The BCH recovery got capped under the $254 level with a 5% gains in a matter of minutes, between the upper line of the 1-hour Bollinger Band as we looking into the latest Bitcoin Cash news.

The intraday RSI implies that the coin is quite vulnerable to the downside correction as the coin rallied from $249 to $254 in just a matter of Monday. While the coin stays below the high of $257 on Sunday, it is still moving in the strong bullish trend line in sync with the rest of the market. BCH/USD is still changing hands at $253 gaining only 2% since the start of the day remaining unchanged in the past day.

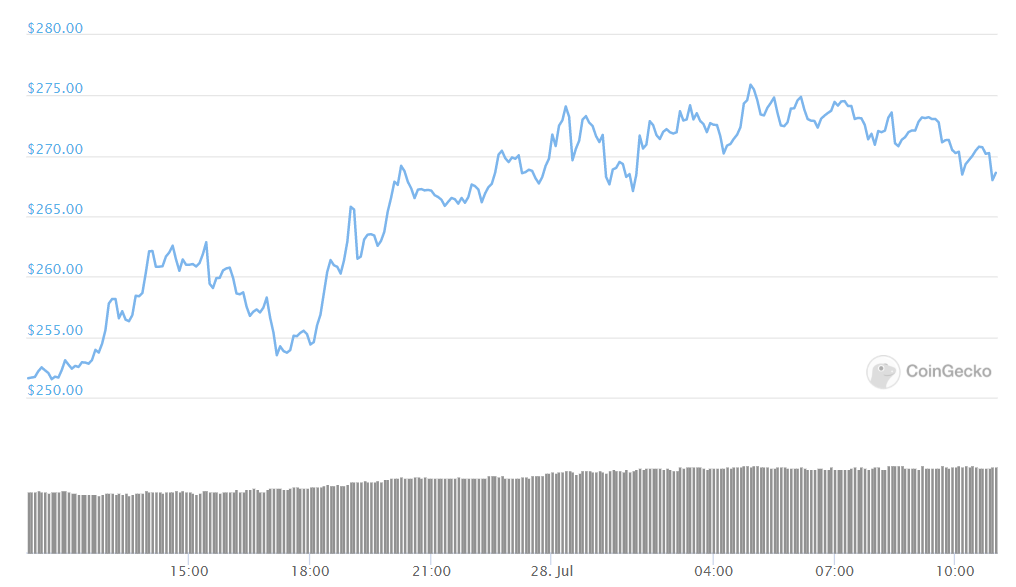

BCH is still the fifth biggest digital asset on the market with a value of $4.6 billion and an average trading volume of $1.84 billion. Looking at the intraday charts, the BCH/USD recovery is capped by the upper line of the $254 level as the local barrier slows down to the upside move the coin but once it manages to go out, the next resistance will be $258 and $260. This area includes the weekly high and the psychological barrier which means that he bulls could need some more time to push away from the 200day SMA and the $273 level.

The BCH recovery is stable at the $254 level and the price could try and move past it making it a strong hurdle on the way to $300. Looking on the downside, the middle line of the 1-hour Bollinger band at $249 serves local support being closely followed by the 50-hour SMA at the $248 level. If the price manages to go past this barrier, the sell-off could be extended into the 100-hour SMA and the psychological $240 level. The critical short-term support can be found at the 200-hour SMA but the short-term looks likely now while the recovery still remains on track.

Bitcoin Cash-the the only hard fork around today that started trading back in 2017, is now left behind. Bitcoin Cash started underperforming bitcoin back in May but two months were more than enough time for the forked cryptocurrency to underperform the leading crypto asset by 18% so far this year. It’s usual for altcoins to outperform bitcoin during the bullish market cycles but altcoins with low or medium market capitalizations often experience high volatility compared to Bitcoin which could yield higher returns if the bitcoin price increases as well.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post