The LEND native token drops by 27% after surging by more than 1000 percent in the past there months as we reported in the previous altcoin news today.

The parabolic rally helped the LEND native token reach an all-time high of $0.384 previously this week. The top formation resulted in a profit-taking process among the daytraders that sent the LEND price lower by 27 percent as per the Santiment report warned about the bearish movement that was based on the growing divergence between the LEND price and the active addresses number. LEND suffered a huge decline in nearly three weeks after rallying more than 1000 percent since April 2020.

The increase in the LEND token came during the booming craze for decentralized finance while Aave still is the best in enabling LEND users to earn interest in deposit and to borrow assets with a stable interest rate. In the meantime, LEND surged thanks to the increase in the user’s number of the lending protocol and on the optimism that surrounded the Credit Delegation launch of the product. The Bids for the LEND tokens are still increasing owing to venture capital funds such as Parafi’s $4.5 million investment into Aave. The parabolic rally helped the token to establish a record high of $0.384 previously in the week.

LEND’s all-time high boosted the daytraders to offset part of their positions in order to secure the short-term profits which are a first sign of selling sentiment that is maturing in a strong downside bias. The LEND/USD exchange rate crashed by about 30 percent from the $0.384 back in July. The Aave token’s drop also came as Bitcoin drew the attention of the traders following the breakout move while the BTC/USD exchange rate closed above the crucial resistance level close to the $9300, starting a new wave of buying force in its market.

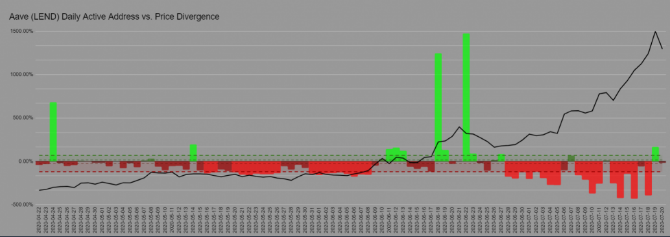

The on-chain data that explains LEND’s price movement includes the transaction volume that started dropping after June 18 which means that the gains recorded after the date came from mostly to the retail traders. The on-chain activity shows that the addresses are selling the LEND token following the parabolic rally. The crypto-focused analysis portal Santiment noted an increasing divergence between Aave’s token price increase and the falling number of active wallet addresses:

“With a pattern like this, it is definitely best to stay away and wait for signals to neutralize and trend back on to the green side slowly but surely.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post