The company eToro was founded in 2006 by two brothers named Ronen and Yoni Assia and their partner David Ring. Now, it is registered as a Limited Liability Company (LLC) as eToro USA. Since then, the brokerage has grown in terms of popularity, especially in financial trading. It also serves as a daily investment platform suitable for everyone. Despite its humble beginnings in 2006, eToro is now one of the best social trading networks. Also, the eToro fees are affordable (as seen in many eToro trusted reviews) and are one of the reasons why many people use this platform. For more information, keep reading our eToro broker review.

eToro Review: Main Features Of The Platform

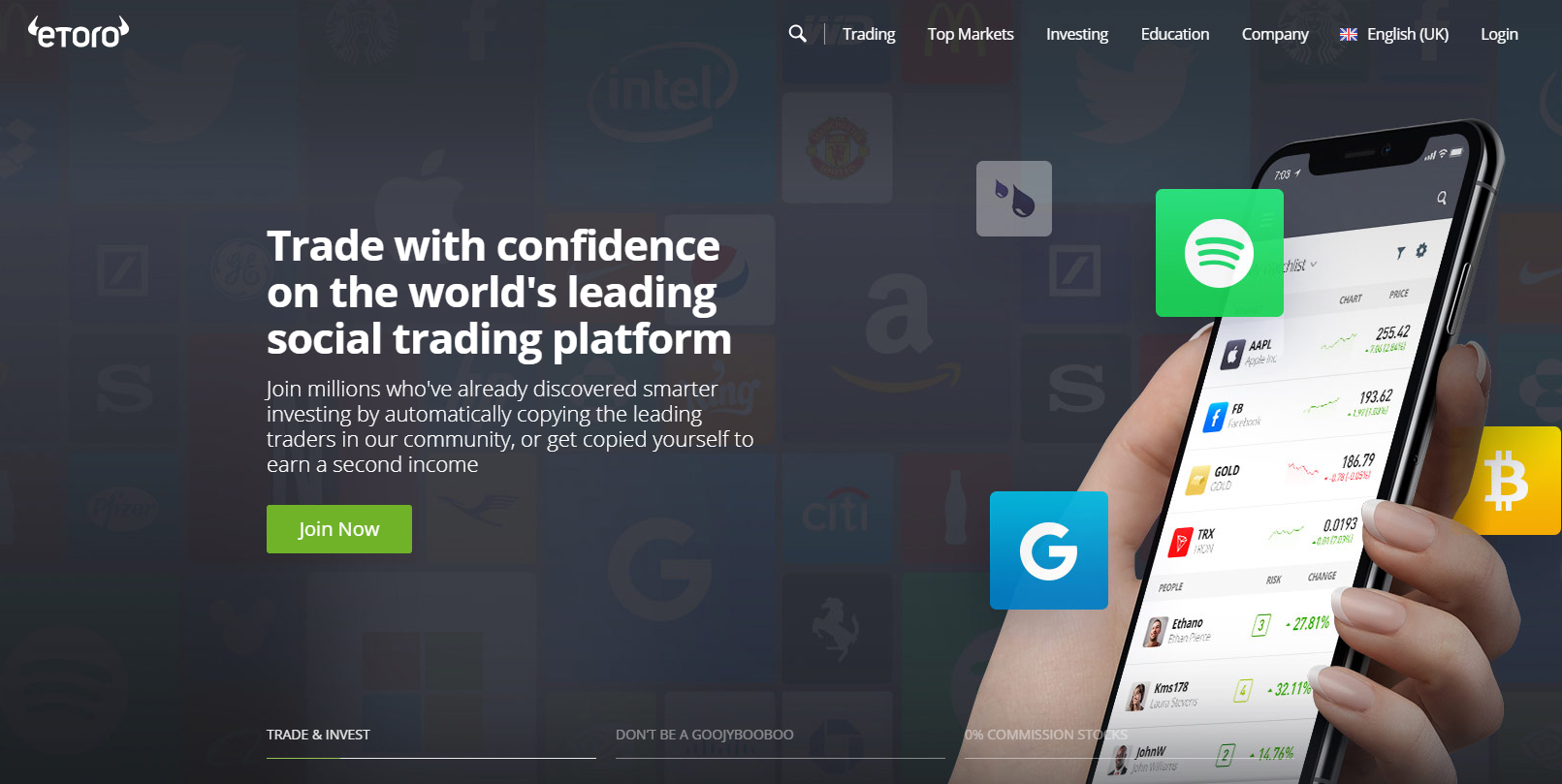

Speaking of which, the network now has more than 5 million users in over 170 countries and all clients have access to trade in stocks, indices, cryptocurrencies, CFDs and commodities. The online platform attracts thousands of new users signing up for accounts every day. As such, it is one of the world’s premier social investment networks.

One thing to note is that eToro is not active in the United States and doesn’t accept customers from the US. However, eToro’s excellent program is available everywhere else and the most striking feature is the online financial trading community which is among the world’s largest. As of recently, eToro replaced its two popular WebTrader and OpenBook trading platforms into an all-in-one platform that gives access to traders to all of the services across a range of devices.

What started as a general trading platform has grown into an all around investment tool that traders from all around the world use on their desktop and mobile devices to keep up with the changing markets and the growing demands. The CopyTrading and CopyPortfolios are excellent features which give beginners a chance to copy expert traders and make most of their investments.

As you would see in many eToro trusted reviews and our eToro broker review, the amount of people trading on eToro are one of the things which are worth considering when signing up. With 5 million active traders, this platform is among the leading on the market.

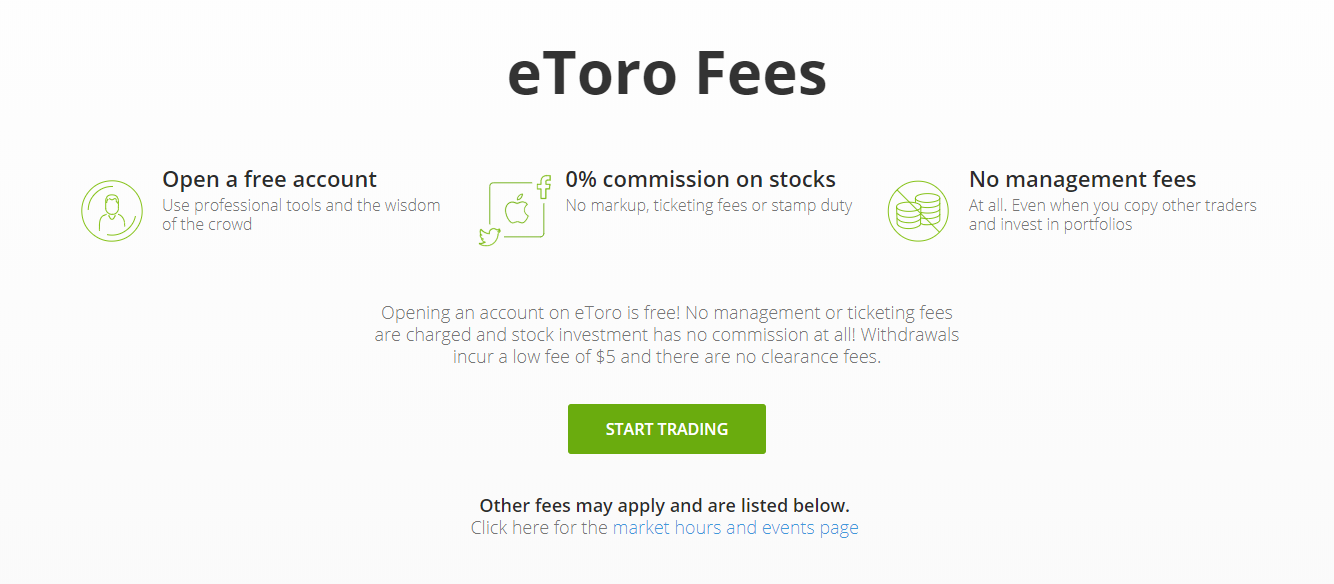

Regulation: How Is eToro Regulated and what are the eToro fees?

For news on regulations, see the section below in this eToro review – or check them

One of the first things that comes to mind to people looking to invest on eToro is regulation. If you are asking yourself “is eToro regulated,” you should know that the brokering services offered by the platform are provided by eToro (Europe) Ltd. (“eToro Europe”) which is a Cyprus-based Investment Firm (CIF) operating under the regulations of the European Union (EU).

The company’s official headquarters are in Tel Aviv, Israel. As far as the oversight and regulations are concerned, eToro (Europe) Ltd. is based in Limassol, Cyprus and is a registered investment firm in Cyprus.

Therefore, eToro Europe is regulated by the Cyprus Securities & Exchange Commission (CySEC) under the license number 109/10. In the UK, the eToro (UK) Ltd. (“eToro UK”) subsidiary is registered under a company registration number 7973792, authorized and regulated by the Financial Conduct Authority (FCA) under the reference number 583263. Both eToro Europe and eToro UK operate and comply with the Markets in Financial Instruments Directive (MiFID).

As you can see on many eToro trusted reviews, the investment platform is also present in Australia, where its services and products are provided by eToro AUS Capital Pty Ltd. (“eToro Australia”) registered under the number ABN 66 612 791 803 and a company that holds an Australian Financial Services Licence (AFSL) 491139 issued by the Australian Securities and Investments Commission (ASIC).

Deposits

Currently, eToro only allows trading in US dollars which means that any deposit in another currency will be converted to that currency upon receipt. The minimum deposit that is required to open a live trading account begins at $50 and goes up to $1,000 depending on the specific regional regulations and the customer’s location.

For instance, if you want to deposit money on eToro via Neteller, you can do that and deposit any amount from $50 to $1,000, with a maximum of $10,000. When it comes to Webmoney and GiroPay, they have the same minimum and a $50,000 and $30,000 maximum respectively. The Russian network Yandex has a $5,000 maximum deposit.

Many eToro trusted reviews list the withdrawal options as one of the advantages of eToro.

Withdrawals

When it comes to withdrawals, as a user you must fulfil a withdrawal form in the Cashier section of the website under the ‘Withdrawal’ tab. The amount that you will enter in the form will be pre-authorized by eToro and you will get notified via email about the withdrawal process. Typically, the best way to withdraw your funds from eToro is via credit card, PayPal or bank transfer (in this order of priority).

For the first time withdrawal, you must submit a clear colour copy of your Passport that includes your written signature and a clear copy of your utility bill that is not older than 3 months and one that was mailed to your residence address. There are no eToro fees for withdrawals.

CopyPortfolios on eToro (CopyTrading)

One of the most popular features on eToro USA is the CopyPortfolios (CopyTrading) which basically allows people to look through the track record of other traders and copy them, which means mirroring their trades.

In this manner, both newbies who want to copy experienced traders benefit, as well as the traders – who get promotions and great deals by working with eToro and getting exposure. If you are new or want to follow some traders on eToro, you can easily do that without paying anything extra. And if you are an experienced trader and want to show everyone how smart your investing is, you can get people copying you and earn big commissions (from referrals) by doing that directly from eToro USA.

People who are scrolling through the best eToro trusted reviews can see that CopyPortfolios are a unique feature to eToro, and one that is absolutely worth having (especially for newbies).

The Selection Of Assets You Can Trade On eToro

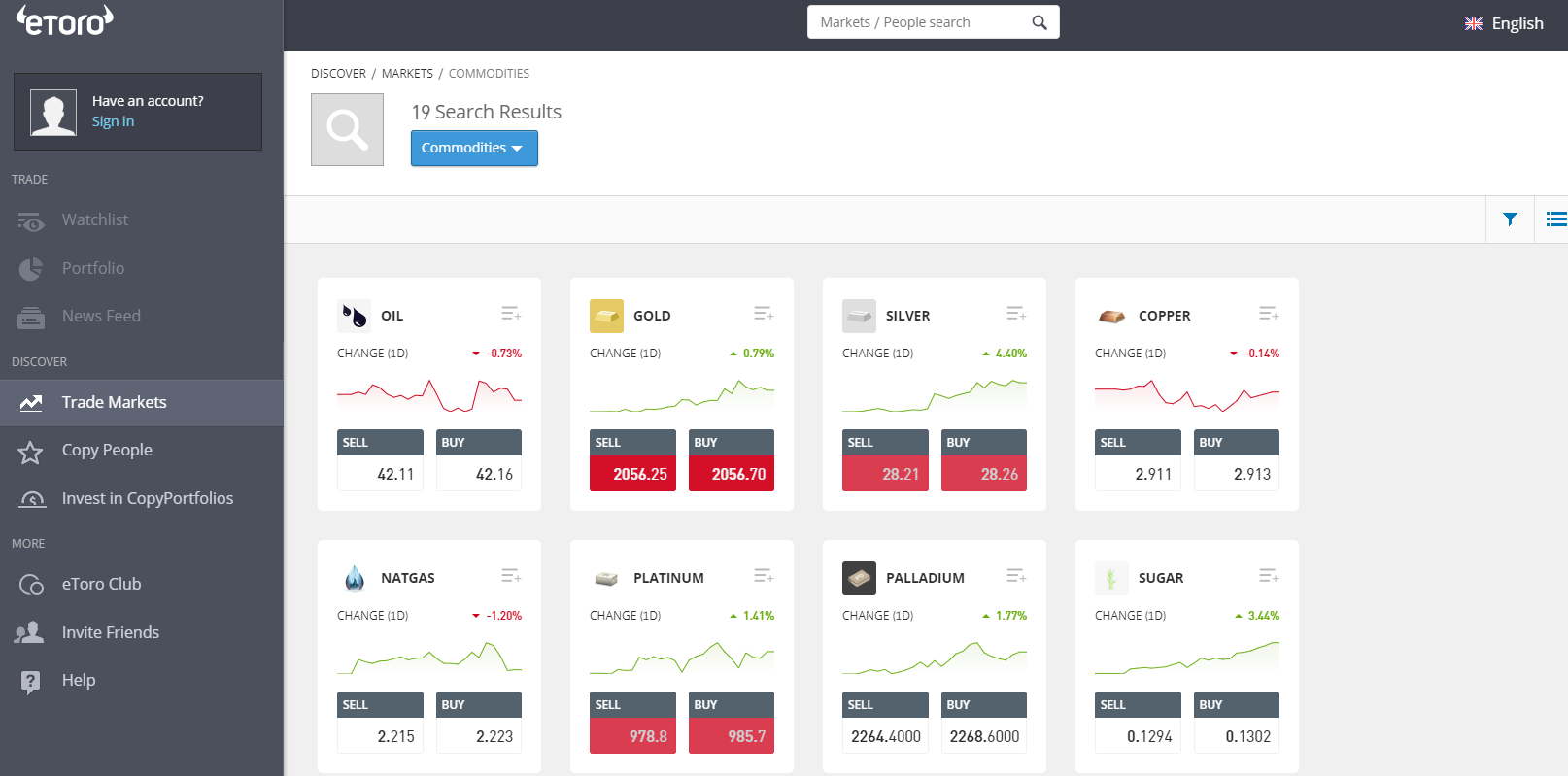

Below, we are listing a selection of assets that you can trade on eToro including stocks, indices, CFDs, cryptocurrencies, ETFs and commodities.

Buying Stocks on eToro

There are hundreds of stocks supported on eToro. The selection is great but not as great as other platforms such as Robinhood, TD Ameritrade or Fidelity Investments (all within the US). However, eToro operates in Europe and gives investors a chance to make profits on a large variety of stocks coming from NYSE and many other markets.

Buying Indices on eToro

There are 13 indices supported on eToro at the moment, including some of the major fiat currencies from around the world and based on USD, JPY, EUR, GBP and other fiat currencies. However, this eToro review will be changed as soon as the platform adds more indices.

Buying CFDs on eToro

CFDs are also known as contracts for difference and a type of derivative trading. With them, investors can speculate on whether the markets will rise or fall. CFD trading on eToro is easy, but you should know that it might be risky because, with it, you are betting if the price of an asset will rise or fall.

Buying Cryptocurrency on eToro

If you want to buy cryptocurrency using eToro, you should know that there is availability for Bitcoin, Ethereum, Bitcoin Cash, Ethereum Classic, Litecoin, Ripple, Cardano, Stellar, NEO, Tezos, Tron, IOTA, Dash, Zcash as well as trading pairs between each of these cryptocurrencies. The list of supported cryptocurrencies on eToro is constantly growing, and the best thing is that you can start trading cryptocurrencies with as low as $25.

For many reading this eToro review, the $25 price point is affordable and a great way to start investing and trading cryptocurrencies.

Buying Commodities on eToro

There is support for 19 commodities on eToro USA including oil, gold, silver, copper, platinum, palladium, nickel and many other commodities that you can invest in. However, the investment limits and therefore, the eToro fees for these are higher.

Buying ETFs on eToro

There are 151 exchange-traded funds (ETFs) on eToro USA, which is a big selection of assets that you can use to make profits. Some of the most popular ETFs are listed within the platform, and there will be support for more in the near future. The eToro fees for ETFs are generally the same.

If you have used Google to search for “eToro broker review” or want to see information about buying ETFs on the platform, visit this link.

So, Who Is eToro Best For?

eToro is great for people who want to try their luck in investing or utilize their knowledge to make money with trading stocks, cryptocurrencies, CFDs, ETFs, commodities, indices and other assets. The platform is easy to use and even easier to set up – which is another great feature you will find highlighted in any eToro broker review online.

If you are new to investing, you can copy others and mimic their strategies, putting your trading on autopilot and hoping for the best. However, regardless of what you choose to do with your money, you should know that trading and/or copy-trading holds no guarantee of gains or losses.

Overall, the usability and trade experience of this platform is great, and the mobile trade experience lets you be present with your money and take control of your investments 24/7 – wherever you are. As a last note, the eToro fees are one of the most attractive features.

eToro USA At A Glance

To sum things up, eToro is one of the largest and most popular investment platforms out there. It offers trading stocks, indices, CFDs, cryptocurrencies and commodities through its desktop and mobile interfaces. The eToro mobile app launched in 2013 and is available for Android and Apple users, while the desktop interface was improved in 2015. In 2016, eToro added CopyPortfolio which allows people to copy expert traders and make most of their market strategies. Crypto was added in 2017, while in 2019 eToro launched eToro, a full crypto-to-crypto exchange. In 2020, eToro plans to launch a debit card for all of its users.

We hope you liked this eToro review and will use it as reference whenever you want to learn more or read more details about this investing platform. For more information about eToro USA, the latest eToro fees and news, visit their website or check out more eToro trusted broker reviews.

The Review

eToro Review

To sum things up, eToro is one of the largest and most popular investment platforms out there. It offers trading stocks, indices, CFDs, cryptocurrencies and commodities thorugh its desktop and mobile interfaces. The eToro mobile app launched in 2013 and is available for Android and Apple users, while the desktop interface was improved in 2015. In 2016, eToro added CopyPortfolio which allows people to copy expert traders and make most of their market strategies. Crypto was added in 2017, while in 2019 eToro launched eToroX, a full crypto-to-crypto exchange.

PROS

- Free stock and ETF trading

- Easy to open account and start trading

- A great social trading experience

- Great coverage on all asset classes

- A chance to copy experienced traders without paying anything extra

- Low limits on cryptocurrencies (only $25 to start a trade)

- Amazing desktop and mobile interface

CONS

- High fees on Forex trading

- Withdrawals can be slow

- Only one base currency (USD)

- High limits for some assets (for instance, you need $500 to trade for one stock)

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post