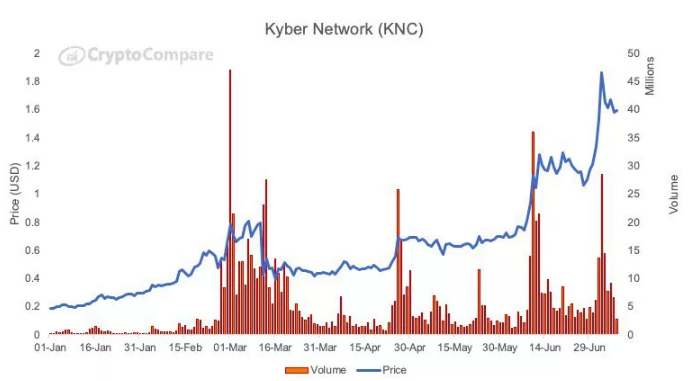

The Kyber Token reached an eightfold increase and outperforms most of the altcoins that are centralized, so let’s see the price analysis in the latest altcoin news today.

The traders however are winning based on the year-to-date performance of digital tokens that are related to the various crypto exchanges. The Kyber token from the Kyber Network Crystal is used to pay trading fees on the decentralized exchange. The token’s price surged eight times in 2020 which compared to Binance coin, marks a 21% increase which customers can use to pay trading fees at a discounted rate. Part of the great performance of Kyber is its fast growth in usage as the daily transactions on the network so far in July are averaging more than double the level in June.

The price moves are also boosted by the speculation of future growth on the market as traders are betting that decentralized exchanges could gain market share in the upcoming time period. Meanwhile, analysts are crunching the numbers and realize that the KNC tokens will provide more yield than the Binance coin. BNB is often categorized by the market taxonomists as a utility token where KNC is seen as a Defi coin. Michael Gord, the CEO of Toronto-based trading firm Global Digital Assets says that he looks at them as rivals in the exchange sector:

“Kyber is actually competitive to exchanges like Binance.”

Kyber announced a new protocol upgrade known as Katalyst which will allow KNC holders to earn staking rewards. These rewards will come from a cut of the trading fees by users of the decentralized exchange. The platform now charges a fee of 0.20% and 65% go to the stakers. But KNC holders can vote to change the fee rates too. Decentralized exchanges such as Kyber are trading platforms constructed on top of Ethereum blockchain with the built-in programming known as smart contracts. This way users can perform actions without the middleman to hold funds and match orders.

No wonder Kyber has lost market share to Uniswap. Those fees are absolutely atrocious. https://t.co/G9k2p4FakS

— DefiMoon (@DefiMoon) July 9, 2020

According to Dune Analytics, decentralized exchanges are reaching a combined volume of about $60 million in July while Binance alone has $2.1 billion volume per day. David Lifchitz, the chief investment officer for ExoAlpha said:

“DEXs are a great development within the digital-asset ecosystem to trade crypto-to-crypto . But it’s not a scalable infrastructure, with the current trading volume, for an active trader.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post