The newly 300 million USDT migration from the TRON to Ethereum blockchain means a whole lot of problems for TRX, so let’s find out more in the upcoming TRON news.

Back on Tuesday, Tether announced the new 300 million USDT migration from the Tron blockchain to the Ethereum protocol explaining that the amount of USDT in circulation will still remain the same which means the users can bypass congestion if needed. The system will also make USDT easier to use for the users that invested in certain platforms to continue transacting in USDT and make the stablecoin something alike platform-agnostic project.

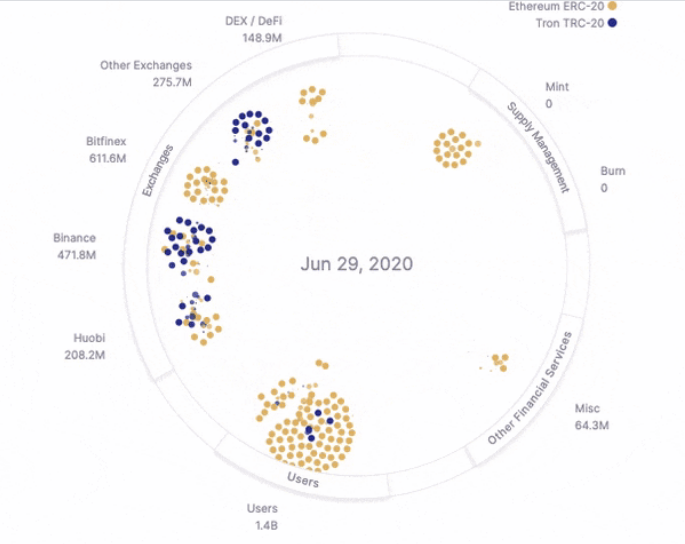

USDT is now available on other chains such as EOSIO, Omni and Liquid but according to the latest data from Tether, 61% of the total USDT supply is on the Ethereum blockchain while 29% of the supply exists on the Tron blockchain while the remaining 9% remain in the other three networks mentioned earlier. According to other data, the swap was conducted by Binance or through it, which sent USDT to Bitfinex for the same amount of USDT tokens.

Although this change could seem fairly trivial to the casual USDT users, $300 million is not a small thing. Those who watch this crypto space close enough will wonder what the exact reason for the swap is, or whether there was a falling out with Tron or is there something better for Ethereum. Given the most dominant token on the Tron, blockchain is USDT, the change can have a huge impact on the network.

An analyst from Flipside Crypto said that one possible reason for the swap is that Tron was paying a premium to keep its token on the blockchain and this deal has officially come to an end. Another possible reason is that Binance wants to participate in yield farming using ERC-20 tokens while decentralized finance became the center of attention in the crypto sphere and there is another possibility for generating passive income.

The recent buzz created around DeFi led to strong rallies for example with tokens such as Aave and Compound that gained 208% and 248% respectively. COMP became the biggest Defi protocol in terms of total value locked. The compound protocol allows the users to earn rewards for borrowing and lending and with the added incentive of earning COMP makes it highly attractive as a passive income source.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post