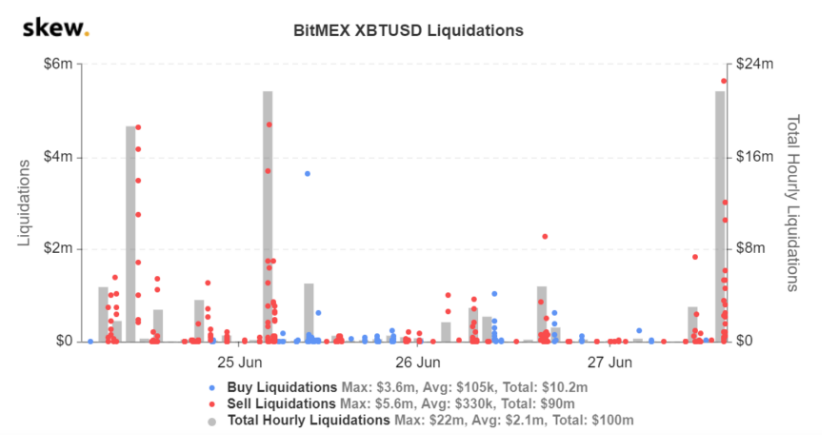

BitMEX longs worth $20 million were wiped from the platform as Bitcoin crashed below the $9000 level on leading spot exchanges and lower on margin-enabled platforms such as BitMEX. In our latest Bitcoin news, we take a closer look at the price analysis.

The move below $9000 caught many of the traders off guard according to the data from Skew.com. the data also shows that BitMEX Longs worth $20 million were liquidated during this move lower. This added to more than $50 million in longs liquidated earlier when bitcoin reached $9000 from $9400. The exchange’s ethereum market also sustained damage as the tracker reported liquidations of more than $1 million worth of ETH contracts.

Considering that these are just two markets from the bigger industry, there were millions more liquidated. Analysts say that the weakness could be a starter to another major drop. Blockroots founder Josh Rager said last week that Bitcoin broke the $9100 level and it means that it will start a new move to $8500. If Rager’s analysis comes true, another move to that level will follow in the upcoming days:

“BTC’s range is clear. Current support that has been holding the past three weeks is the mid-range Break down here and price likely to see $8900 followed by $8500 range bottom.”

One trader even argued a few days ago that Bitcoin is trading in a textbook Wyckoff Distribution which is a bearish chart and pattern that appears during bull trends:

“A couple more clues developing that lend themselves to HTF distribution. 1. Rising Demand on the verge of failing. 2. Side by side, ascent vs descent with selling the dominant pressure from volume. We break to the downside, I’m not interested in $7ks. Much lower.”

The bearish analysis can be corroborated by the fundamental trends. The on-chain analyst Cole Garner noted that Bitcoin’s next major move will likely be to the downside. He attributed the sentiment to the growing sell-side pressure from the miners and the weak buy orders on BitFinex as well as institutions getting short on BTC via the CME. Also, the PlusToken scam managed to distribute the cryptocurrency to multiple wallets. DTC Capital’s Spencer Noon reported that the scam is trying to liquidate more than $450 million.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post