Bitcoin Miners return after the 10% difficulty drop as the fears enhanced that they capitulated due to the slow block speed and increase in transaction fees. The data analysts observed huge outflows from miner wallets as we are reading further in the Bitcoin latest news today.

What happened was the block reward halving that reduced the revenue of miners by about 50%. After the halving in mid-May, the hedge fund manager, and chief executive officer at Blockware Mining, Matt D’Souza, said that 30% of Bitcoin miners risked extreme capitulation. As the blocks slowed, the assertion was proved correct. After the automatic adjustment to the Bitcoin network difficulty that determines how hard it is for the blocks to be miner, it seems that Bitcoin miners return.

We've seen 12 blocks produced within a single hour three times today already.

Yesterday 14 blocks were mined within a single hour.#Bitcoin https://t.co/BwmBNCShfq pic.twitter.com/XYF20mjcY1

— Rafael Schultze-Kraft (@n3ocortex) June 6, 2020

Every 2016 block which is about two weeks in time, there is an automatic adjustment to Bitcoin’s difficulty. The protocol tries to adjust the metrics to ensure the blocks are mined every 10 minutes which keeps the network conditions normal. Three days ago, the latest adjustment hit which resulted in a -9.29% difficulty adjustment which was the seventh-largest move lower and also the fourth negative one since the start of this year. Miners were quick to turn on their machines and responded to the difficulty adjustments in a short-term bid to boost their profitability.

Rafael Schultze, the CTO of blockchain analytics company Glassnode, shared a chart that shows how in the past 24 hours of his analysis, there were three separate hours in which 12 blocks doubled the status quo of the blocks per hour that were mined. This happened due to the increased number of miners in the crypto space:

“We’ve seen 12 blocks produced within a single hour three times today already. Yesterday 14 blocks were mined within a single hour.’’

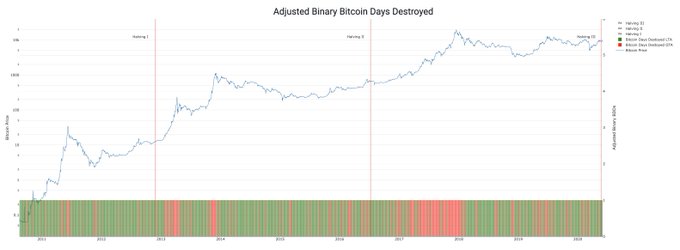

It shows that the fears of the miner capitulation are not valid anymore as they were earlier. This is also related to Bitcoin because the miners capitulating is believed to be what drove Bitcoin from the $6,000 to $3,150 back in 2018 alongside other macro drops on the market. The on-chain data shows that despite the increase in the number of mined blocks, the miners continue to accumulate Bitcoin. Since they accumulate and not sell, they are decreasing the amount of the selling pressure that hits the market.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post