The Bitcoin news today show that Coinbase publishes a report in which it says that the most dominant coin, Bitcoin (BTC), is superior to gold. The cryptocurrency exchange published the report and argued that disruptions during the pandemic highlight the advantages of Bitcoin over gold.

The leading US-based cryptocurrency exchange also argued that Bitcoin offers a distinct advantage over gold. As the team noted, Bitcoin is afforded these advantages by its lack of dependance on physical supply chains.

We can also notice that as Coinbase publishes the report related to BTC, its authors assert that “Bitcoin and gold are fundamentally similar as scarce and globally accessible units of value.” With this, Coinbase advances that gold’s recent supply squeeze is resulting from the impacts of the coronavirus pandemic and has highlighted the superior global accessibility of Bitcoin (BTC).

In the Coinbase news today, we can see a new advance as BTC is now above $8,900 and once again more than ready to breach the $9,000 mark. The fact that Coinbase publishes a report may only give the dominant coin a push in the back – one that BTC truly needs.

Coinbase also advances that the COVID-19 pandemic has illuminated the advantages that BTC offers over gold, asserting that “Bitcoin does not rely on fragile physical supply chains and is truly globally accessible.” The exchange also emphasizes the recent price gaps exhibited by gold markets worldwide, as disruptions to supply chains result in disparate levels of scarcity across all the different markets.

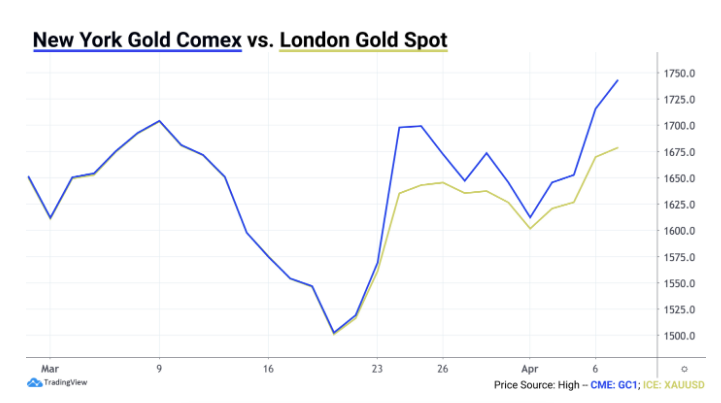

We can see that Coinbase publishes this report where it notes a roughly 4.5% divergence in the price of gold in New York and London. This divergence, as we can see now, resulted from a lack of gold bars that are used to settle Comex’s futures contracts.

“Bitcoin’s rate of new supply is ~3.6% per year and will soon drop to ~1.7% on May 12th, setting it on par with gold’s historic scarcity. As gold miners and refineries have gone offline, Bitcoin’s global mining ecosystem seems resilient according to hash rate measurements in recent days,” the exchange noted.

Coinbase publishes this report and notes that the Bitcoin markets are currently posting year-to-date gains of 20% and 12%, respectively. If we remember BTC’s price in November 2019 being in the lows of $3,000, today’s levels make it a tripling of that price.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post