A new report by Xpring is in the ETH news today, showing that XRP exchanges see increased inflow and outflow volumes whenever Bitcoin and Ethereum networks are hit by the surging transaction fees and the issue of congestion. As the report says, traders move to XRP for cross-exchange transactions and during what is known as the “crunch” on the markets.

Even though the report did not specify sample sizes in terms of days, Xpring notes that XRP cross-exchange transactions went up significantly and Ethereum (which is used widely as a market on-ramp) was congested.

As a result, traders move to XRP to evade this. The report also talked about Bitcoin fees and mentioned how they went up by a maximum of 500% in the weeks leading to the halving. On the other hand, Ethereum’s network was similarly strained – some days in March this year saw the network facing waiting times of 44 minutes per transaction even though the fees did not increase as much.

#ETH network congestion. Average time for confirmations 2680 seconds (44 minutes) https://t.co/a2U8vF3Q9P pic.twitter.com/nPENzWA4yH

— CZ Binance 🔶🔶🔶 (@cz_binance) March 12, 2020

According to Shae Wang of Xpring who was the author of this report, such periods led to difficulties in inter-exchange flows, too. Notably, the dominant coin is dominated by traders and arbitrage seekers – and the inflated fees or slower transaction times show that investing strategies are heavily impacted.

“The observed XRP transactions increase is likely a result of traders using XRP as an alternative rebalancing asset.”

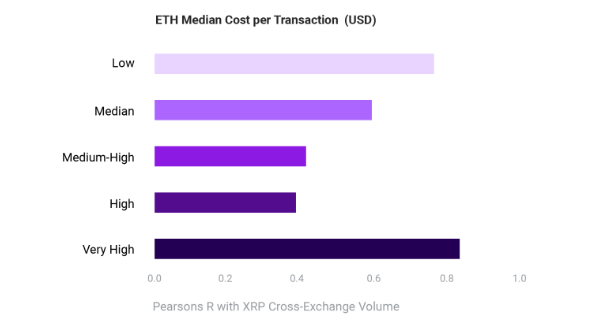

Meanwhile, we can see that as traders move to XRP, the cryptocurrency emerges as a transfer alternative ahead of many other options. In the XPR news today, Wang pointed out to cross-transaction data – XRP transfers rose 226% when Ethereum fees spiked by 400% in March this year.

There have been many different metrics validating the hypothesis. We can also see that traders move to XRP because of other reasons, but the transaction fees are obviously the biggest one.

At last, the report noted that XRP fees remained relatively stable even as the BTC/ETH fees surged. As a reminder, XRP has never been used for liquidity this widely in both crypto and traditional markets.

As we can see from the cryptocurrency prices now, the price of Ethereum (ETH) is at $195 now, while the XRP token just crossed the $0.20 mark once again this month.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post